Best Cloud-Based Accounting System & Bookkeeping Software for Small Businesses

Accounting software for small businesses combines user-friendly, cloud-based accounting software and bookkeeping software for small businesses, offering scalable accounting solutions. This online accounting software for small businesses includes key account management tools, accounting packages, and personal accounting software for efficient accounts management.

- What is Accounting Software?

- Why Accounting Software Matters

- Accounting Software for Small Businesses

- Why Do You Need Accounting Software?

- Key Benefits of Using Our Accounting Software

- Features of AccountGo Accounting Software

- AccountGo SaaS vs Non-SaaS Solutions

- Why Choose accounting software by Workdo?

- Get All the Critical Tools to Manage Business Finances

- Manage Accounting Quickly and Easily

- Handle Inventory Tasks Without Stress

- Take Your Project From Proposal to Payment

- Frequently Asked Questions

What is Accounting Software?

Accounting software is a digital tool that helps businesses automate and manage their financial tasks efficiently. It simplifies bookkeeping, invoicing, payroll, expense tracking, and financial reporting, saving time and reducing errors. For small businesses, bookkeeping software for small business owners is especially valuable, as it offers easy-to-use features tailored to their needs. Cloud-based accounting software has become increasingly popular because it allows users to access financial data securely from anywhere, enabling real-time collaboration with accountants and team members.

Platforms like Workdo.io’s accounting system offer advanced online accounting software solutions that integrate seamlessly with other business operations. These solutions range from basic accounting tools for startups to comprehensive programs tailored for larger businesses. Choosing the right accounting software ensures accurate financial management and provides valuable insights that support business growth. Workdo.io’s cloud-based accounting system is a prime example of an all-in-one online solution, ideal for small to medium-sized businesses seeking reliable and user-friendly accounting tools.

Definition and Meaning of Accounting Software

Accounting software is a digital tool that automates the recording, storing, and processing of financial transactions. It simplifies essential tasks like bookkeeping, invoicing, payroll, and financial reporting, helping businesses maintain accurate records and comply with tax requirements. Modern cloud accounting software, such as platforms like Workdo.io, offers online access and real-time collaboration, making financial management easier for small and medium businesses.

Core Functions and Capabilities of Accounting Software

Accounting software automates key financial tasks including transaction recording, managing accounts payable and receivable, and tracking expenses. It also supports invoicing, payroll management, and generates detailed financial reports like profit and loss statements and balance sheets. Advanced cloud accounting software platforms like Workdo.io enable real-time data access, multi-user collaboration, and integration with other business tools, providing a comprehensive online accounting software solution for efficient financial management.

Why Accounting Software Matters

Accounting is the backbone of any business, involving the recording and management of financial transactions. Modernizing financial management by shifting from manual bookkeeping to software accounting enhances accuracy and efficiency. Understanding what is accounting software and its meaning is essential to adopting effective accounting solutions.

Accuracy and Error Reduction

Automated calculations in basic accounting software minimize human errors, reducing risks in tax filings and financial reporting. Built-in validations and reconciliation tools in online accounting software ensure reliable and consistent data management, crucial for smooth software for accounts operations.

Time and Cost Efficiency

Using easy accounting software accelerates invoicing, payroll processing, and reporting. Automation reduces manual data entry and dependence on spreadsheets, helping businesses cut down labor costs. Cloud-based accounting application solutions further streamline these processes.

Real-Time Financial Insights

Dashboards and analytics provided by the accounting software best enable smarter decision-making. Forecasting tools track cash flow and expenses, while accounting system online platforms offer instant access to financial data across multiple devices, improving agility.

Scalability and Customization

Different types of accounting software allow businesses to select modular accounting software packages tailored to their growth stages. Business accounting software offers customizable workflows suited for diverse industries, ensuring flexibility and scalability.

Better Compliance and Security

Cloud-based accounting software helps businesses stay updated with evolving tax laws. Features like secure cloud backups, data encryption, audit trails, and access controls enhance data protection. Choosing the best accounting software from a reliable accounting software company ensures compliance and security.

Seamless Integration with Other Tools

Integrations with account management, CRM, ERP, payroll, and payment systems centralize financial and operational data. Customer account management software and accounts manager software improve business-wide coordination and efficiency.

Mobility and Remote Access

Cloud platforms offer cloud accounting software, enabling employees to work from anywhere. Online accounting software and small business solutions empower mobile and hybrid teams through secure and accessible account management online systems.

Improved Decision-Making

Accurate data from accounting software for small businesses supports strategic financial planning. Features like budget tracking and performance measurement within account management software and bookkeeping software for small businesses drive better business outcomes.

User-Friendly Interfaces for Non-Accountants

Modern software emphasizes simple UI and guided setups, ideal for small business owners and freelancers. Simple accounting software and best small business accounting software offer accessible best account management software tools without needing deep accounting knowledge.

Enhanced Client and Vendor Management

Accounting platforms include features to track invoices, payments, and credits effectively. Tools like account manager tools, customer account manager software, and account management services streamline managing contacts and transaction histories for better relationships.

Accounting Software for Small Businesses

Importance of Small Business Accounting

Effective financial management is crucial for small businesses to thrive. While bookkeeping involves the day-to-day recording of transactions, accounting provides a broader analysis and interpretation of this data to inform decision-making. Choosing the right bookkeeping software for a small business simplifies this process, helping owners track expenses, revenues, and financial health effortlessly.

With easy accounting software, small businesses can automate routine tasks like invoicing and expense tracking, reducing errors and saving valuable time. Utilizing the right accounting software for small businesses or small business accounting software ensures smoother operations and better financial control.

Top Features for SMEs

Small and medium enterprises benefit greatly from features like automated invoicing, inventory management, and client management. These tools help businesses maintain accurate records, manage stock levels, and foster strong customer relationships.

Choosing simple accounting software is essential, as it offers intuitive interfaces designed for non-accountants, enabling business owners to focus on growth rather than complex bookkeeping. The best accounting package for small businesses includes functionalities such as tax management, multi-user access, and customizable reports, making accounting packages for small businesses a smart investment for sustainable success.

Why Do You Need Accounting Software?

Accounting software is a tool that the process of recording, storing, and analyzing financial transactions. Unlike traditional bookkeeping, cloud based accounting software like AccountGo allows you to access your financial data anytime, anywhere, making it easier to manage your accounts in real time.

With accounting solutions such as AccountGo, small businesses can automate invoicing, track expenses, generate reports, and stay compliant with tax regulations effortlessly. This means less manual work, fewer errors, and more time to concentrate on your core business activities.

Key Benefits of Using Our Accounting Software

1. Full Source Code Access

A powerful accounting software that provides full source code access gives businesses the ability to fully customize their financial system. Whether you need to integrate with other tools, modify reports, or create additional modules, source code access ensures your account management system grows as your business evolves.

2. Premium Support

One of the biggest advantages of a quality accounting software package is premium support. Quick and reliable customer assistance helps resolve technical issues faster, minimizes downtime, and ensures your accounting solutions run smoothly with professional guidance whenever you need it.

3. Lifetime Updates

Many businesses seek simple accounting software with the assurance that it won’t become outdated. With lifetime updates, your online accounting software remains secure, compatible with the latest standards, and equipped with new features—without any hidden costs or recurring charges.

4. White Label Product

For agencies or service providers, having a white label option in your cloud based accounting software is a game changer. It allows you to rebrand the software under your own name, offering account management services or reselling it as your own product. This flexibility can become a new revenue stream for your business.

5. One-Time Payment

Unlike many modern tools that rely on monthly subscriptions, choosing an accounting software that offers a one-time payment option helps manage expenses more effectively. It’s ideal for small businesses looking for basic accounting software without long-term financial commitments.

Features of AccountGo Accounting Software

AccountGo is designed to be a comprehensive accounting application software tailored to meet the needs of small businesses. Some of its standout features include:

- Cloud Accounting Software: Access your accounts securely from any device.

- Easy Invoicing and Billing: Generate and send professional invoices quickly.

- Expense Management: Keep a close eye on your business spending.

- Integration: Connect seamlessly with other business tools you use.

- User-Friendly Interface: Designed for users with no accounting background.

These features make AccountGo one of the best accounting packages for small businesses available today.

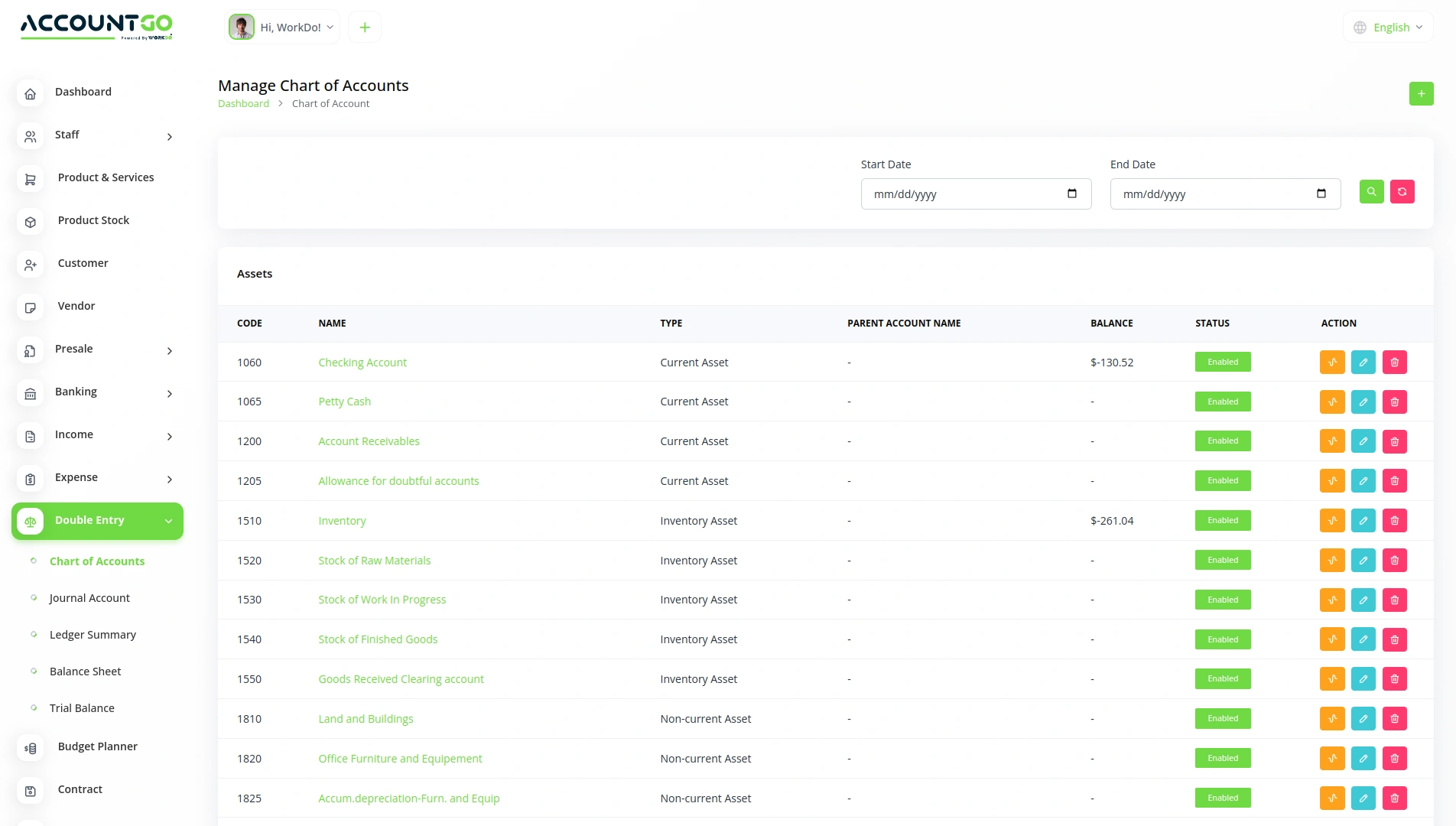

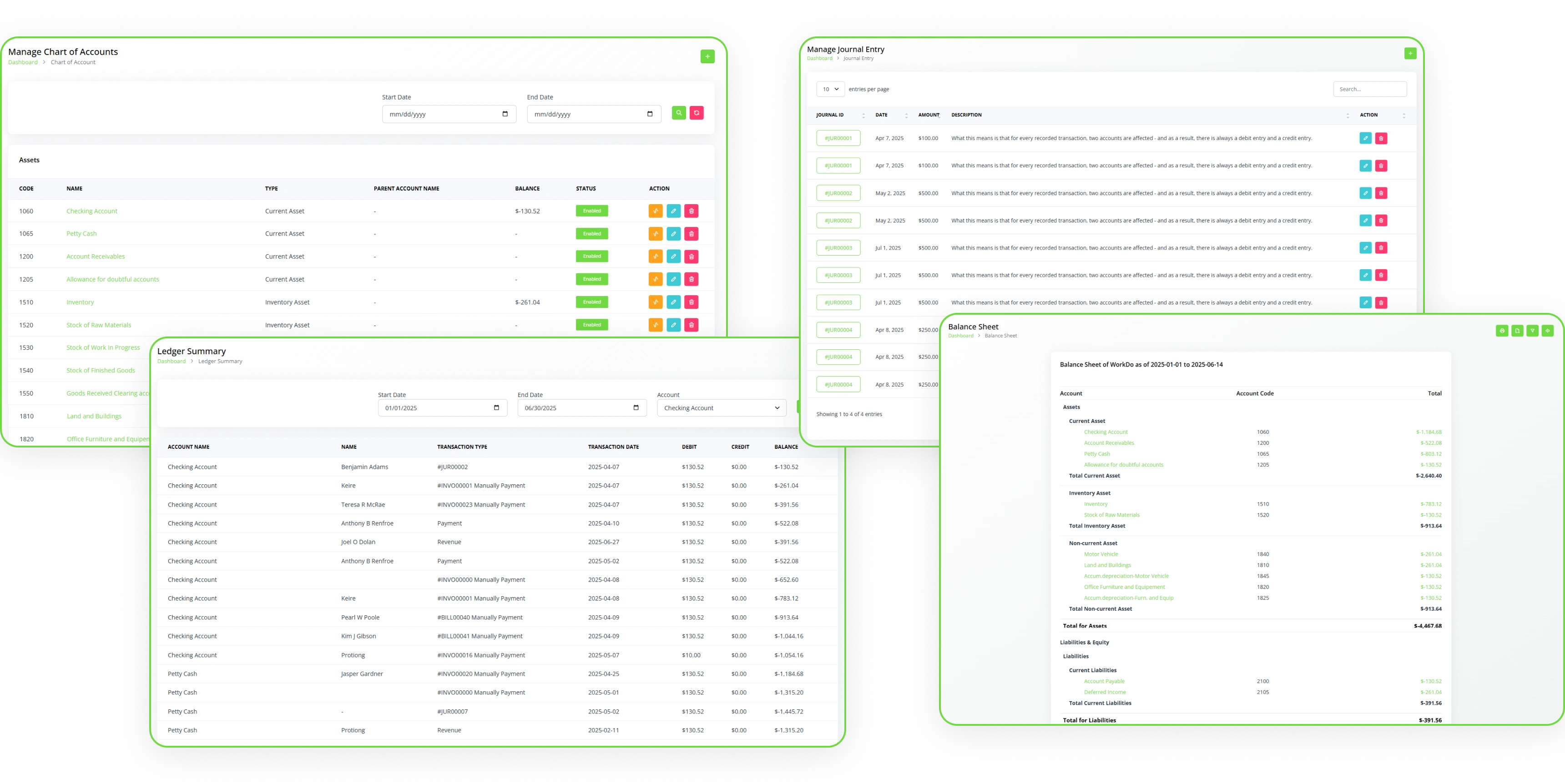

🔄 Double Entry Accounting System – Built for Accuracy

Workdo.io offers a robust double entry accounting system that ensures every financial transaction is accurately recorded and balanced. This essential feature is the backbone of modern accounting software, helping businesses maintain financial integrity, comply with regulations, and make smarter decisions.

📘 Chart of Accounts

The Chart of Accounts is the foundation of your financial system. It organizes all your accounts—assets, liabilities, equity, income, and expenses—into a structured format. With Workdo.io’s cloud accounting software, you can easily customize or expand your chart as your business grows.

🧾 Journal Account

Record every transaction in real time using Journal Accounts, ensuring compliance with standard bookkeeping software for small business practices. Workdo.io allows for quick entries and automatic posting to the ledger, minimizing human error.

📒 Ledger Summary

Access detailed Ledger Summaries that provide a complete view of account movements. This feature in our accounting application software enables accurate reporting, audit trails, and financial reviews for internal and external use.

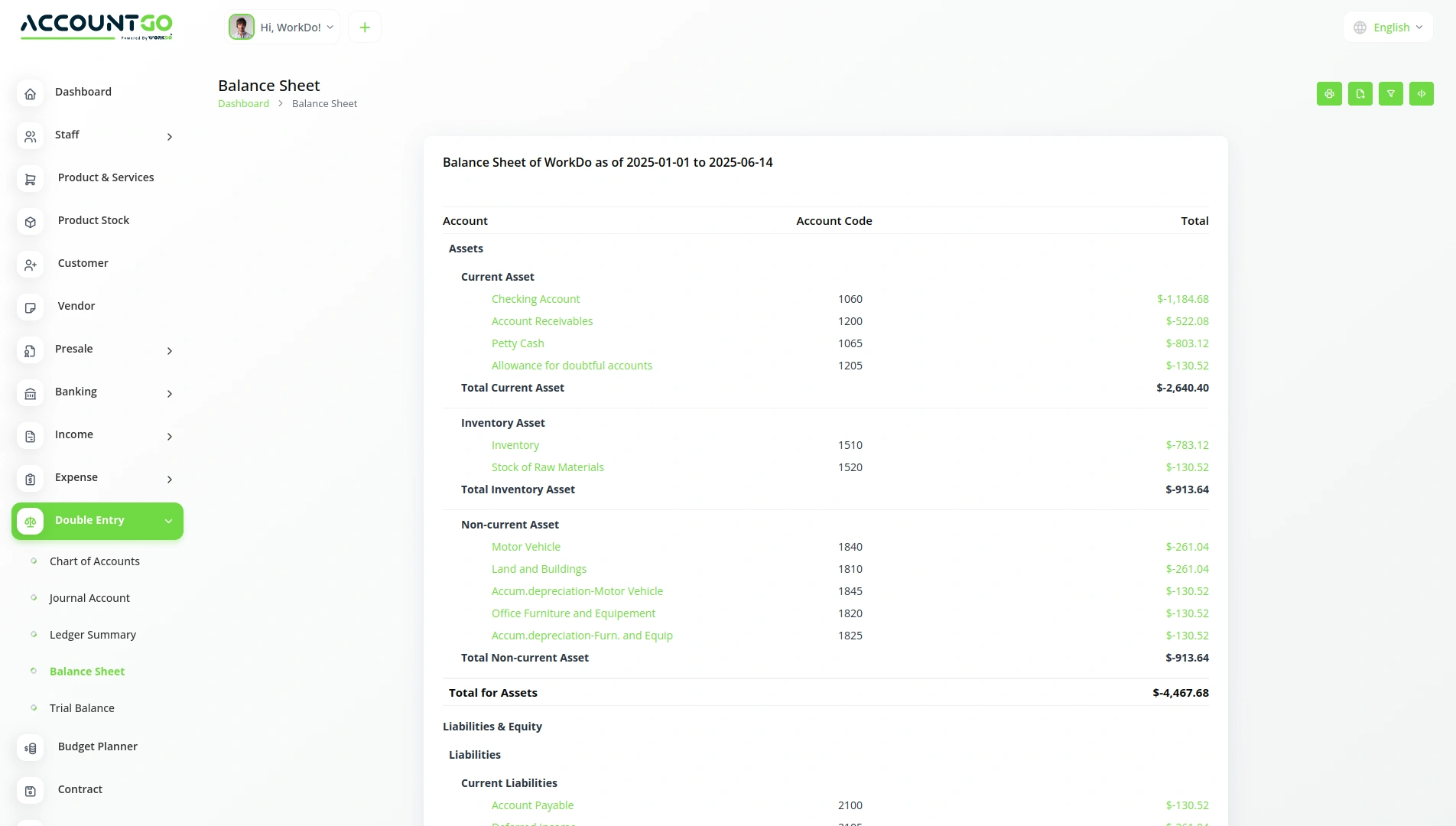

📊 Balance Sheet

Generate professional balance sheets with a single click. Whether you’re running a small business or managing a large enterprise, Workdo.io’s accounting software provides real-time insights into your company’s financial position.

📈 Trial Balance

Workdo.io’s Accounting system simplifies audit readiness with Trial Balance reports that validate the equality of total debits and credits. This tool is essential for clean financials, especially when switching accounting software companies or preparing for year-end reports.

AccountGo SaaS vs Non-SaaS Solutions

AccountGo offers two distinct versions to meet the varied needs of businesses: SaaS (Software as a Service) and non-SaaS accounting solutions.

The SaaS version is ideal for businesses looking for a centralized platform to manage multiple companies under one roof. With one Super Admin, you can easily register and manage multiple companies and their users, all from a single dashboard. This version also includes built-in subscription and registration functionalities, making it perfect for service providers or multi-company setups.

In contrast, the Non-SaaS version is a self-hosted solution that supports a single company with multiple users. It’s designed for businesses that prefer full control of their software environment.

Which One is Right for You?

- Choose AccountGo SaaS if you need to manage multiple companies with ease, offer role-based access to multiple users per company, and want built-in subscription and registration features—all accessible from a central Super Admin panel.

- Choose AccountGo Non-SaaS if you only need to manage one company, want multiple user access within that company, and prefer a simple, one-time software purchase.

Why Choose accounting software by Workdo?

In today’s crowded market of accounting software packages, choosing the right solution for your business can be overwhelming. However, AccountGo by Workdo clearly distinguishes itself with a powerful blend of features, affordability, and user-centric design that caters especially to small and medium-sized businesses.

💡 All-in-One Accounting and Billing Solution

AccountGo is not just an accounting software; it’s a complete financial management system. It integrates accounting, invoicing, inventory management, and tax automation into one seamless platform. This eliminates the need for juggling multiple tools, allowing you to streamline your entire accounting workflow in one place.

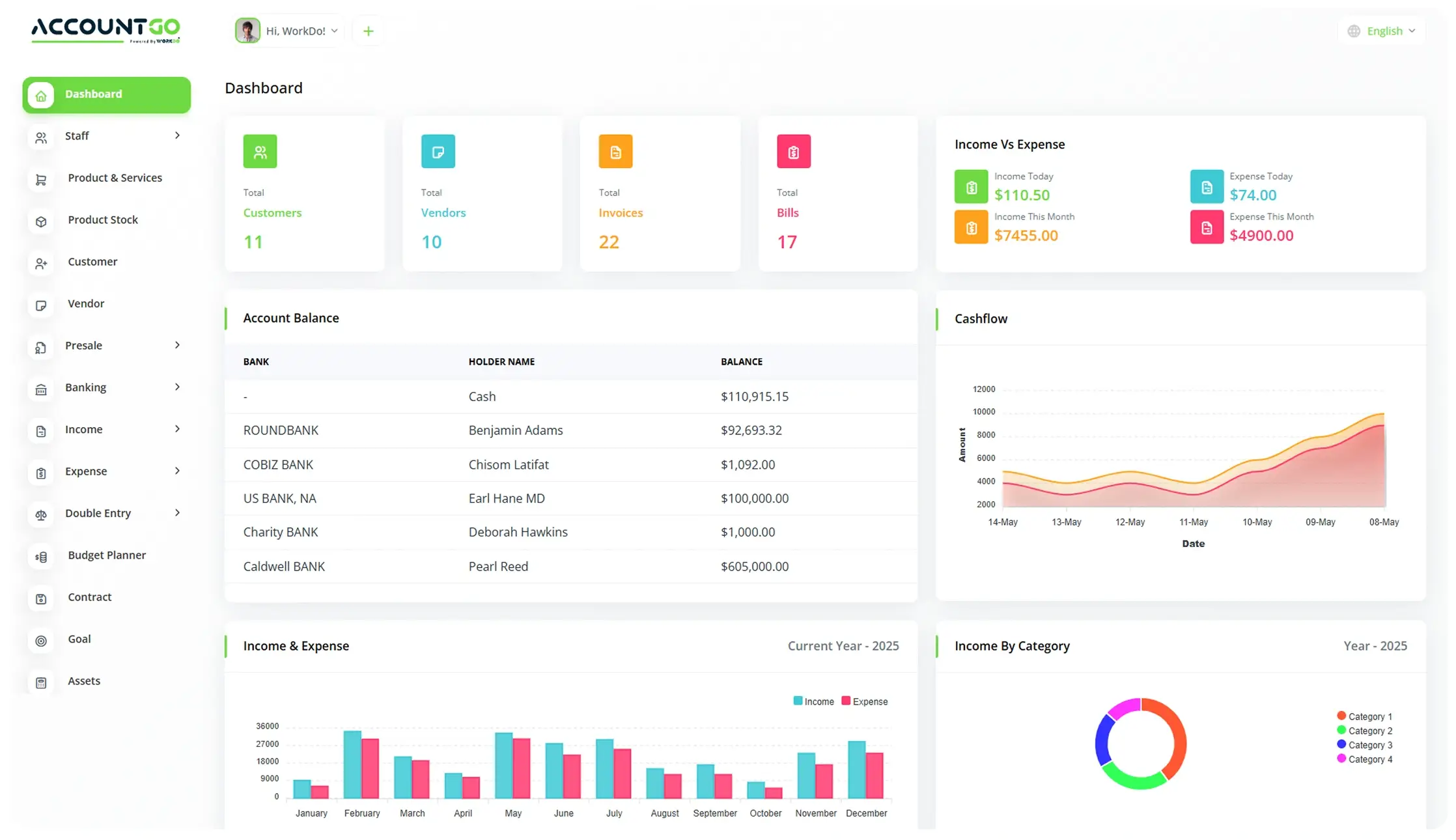

🖥️ User-Friendly and Customizable Dashboard

Even if you have no prior accounting experience, AccountGo’s intuitive interface makes managing your books simple and straightforward. The customizable dashboard allows you to keep track of key financial metrics at a glance, empowering you to make informed business decisions quickly.

🔒 Affordable Pricing with Full Ownership

Unlike many cloud-based SaaS models that charge recurring fees, AccountGo offers a one-time affordable payment. You also receive full access to the source code, giving you the flexibility to customize the software as your business evolves — a rare benefit in the accounting software space.

🌍 Global and Multilingual Support

AccountGo supports multiple languages, including RTL (right-to-left) languages, making it an ideal choice for businesses operating in diverse regions. This global accessibility ensures your accounting system is as inclusive and versatile as your market demands.

📈 White Label & Scalability

For businesses or agencies wanting to provide branded accounting services, AccountGo’s white-label feature allows complete rebranding of the software. Plus, it scales seamlessly as your business grows, handling increasing transaction volumes without compromising performance.

🛠️ Premium Support and Lifetime Updates

Workdo’s dedicated support team ensures you’re never left in the dark. AccountGo customers enjoy premium technical assistance along with lifetime updates, keeping your software secure and packed with the latest features.

Get All the Critical Tools to Manage Business Finances

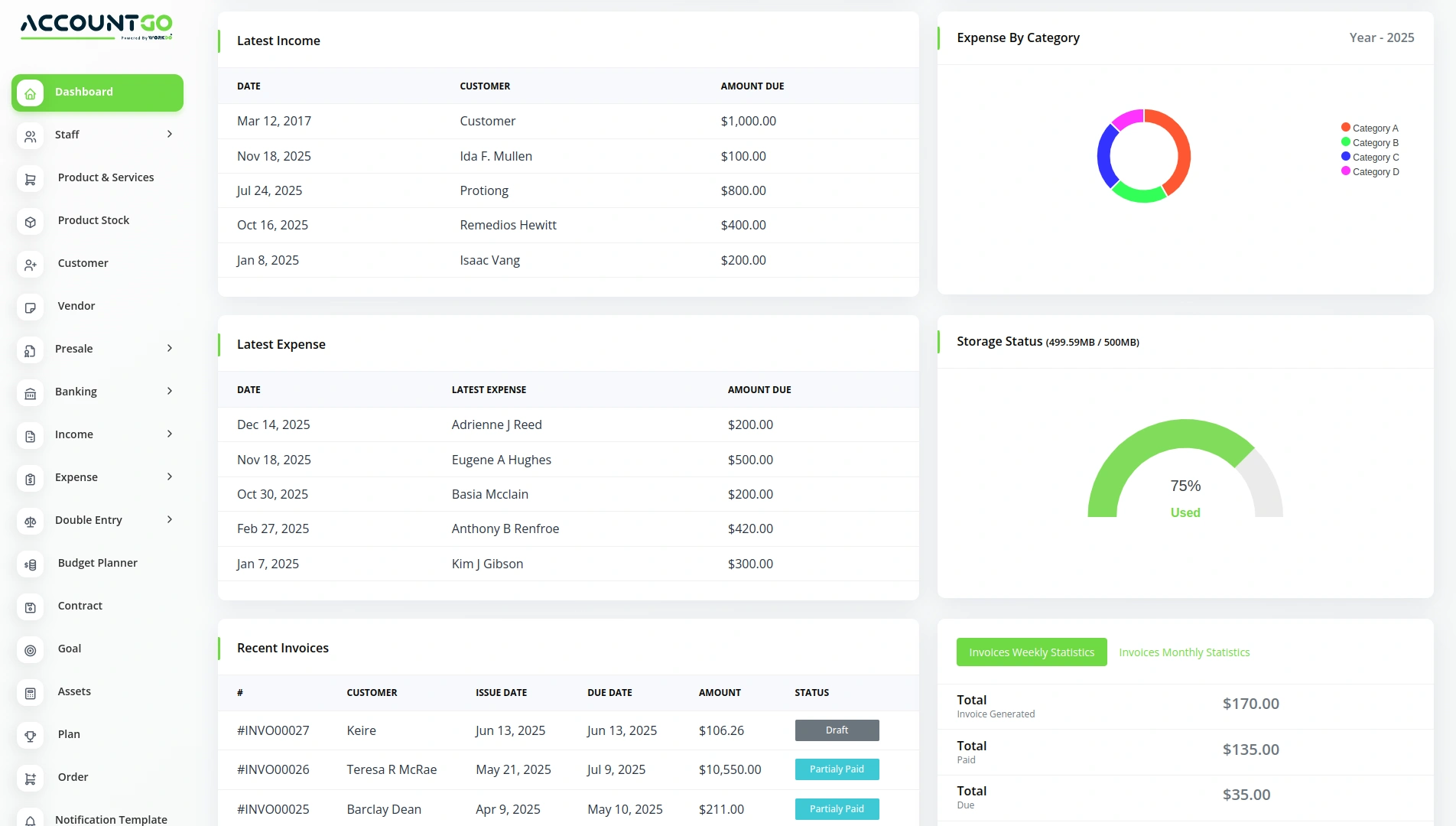

In today’s digital-first economy, managing business finances with precision, speed, and intelligence is not optional — it’s essential. Whether you’re a startup founder, small business owner, or finance manager, the right accounting software can transform the way you operate. Platforms like Workdo.io’s accounting system empower businesses to streamline processes with integrated tools for accounting, inventory management, and payment tracking — all from a single, user-friendly interface.

Let’s explore how an intelligent accounting system online gives you all the essential tools you need to thrive.

Manage Accounting Quickly and Easily

Modern businesses can no longer afford to rely on outdated spreadsheets or complex manual processes. With advanced accounting software, you can automate key financial tasks like invoicing, billing, and tax calculations. This type of accounting application not only ensures accuracy but also saves time, reduces human error, and allows seamless monitoring of your cash flow.

Whether you’re using cloud accounting software or an online accounting software small business package, automation lets you set financial goals and monitor performance without lifting a finger.

Small companies especially benefit from bookkeeping software for small business, which simplifies compliance and reporting without requiring a full-time accountant. This type of business accounting software can be deployed as account management software, helping you manage income, expenses, and even payroll in one place.

For those looking for the best accounting software for small business, Workdo.io provides intuitive dashboards, integrated tax automation, and customizable features. You can also find the accounting software best suited to your industry with flexible accounting packages that scale as your business grows.

Handle Inventory Tasks Without Stress

Inventory is the backbone of product-based businesses. Using software accounting platforms like Workdo.io’s Accounting Software, you can create inventory categories, assign products, adjust pricing, and manage stock without ever touching a spreadsheet. This accounting software for small business goes beyond finance — it’s also your complete inventory management system.

With features like SKU generation, tax rate customization, and dynamic pricing, you’re not just managing products — you’re optimizing them. This level of functionality is typical in cloud based accounting software, giving you access and control from anywhere.

If you’re dealing with a wide product catalog, you’ll need the right accounting application software to handle frequent changes. Cloud integration makes it ideal for managing business finances on the go.

Small enterprises can choose the best accounting package for small business that includes inventory tools — eliminating the need for third-party apps. Workdo.io offers a unified dashboard for inventory and finances, making it the ideal software for accounts.

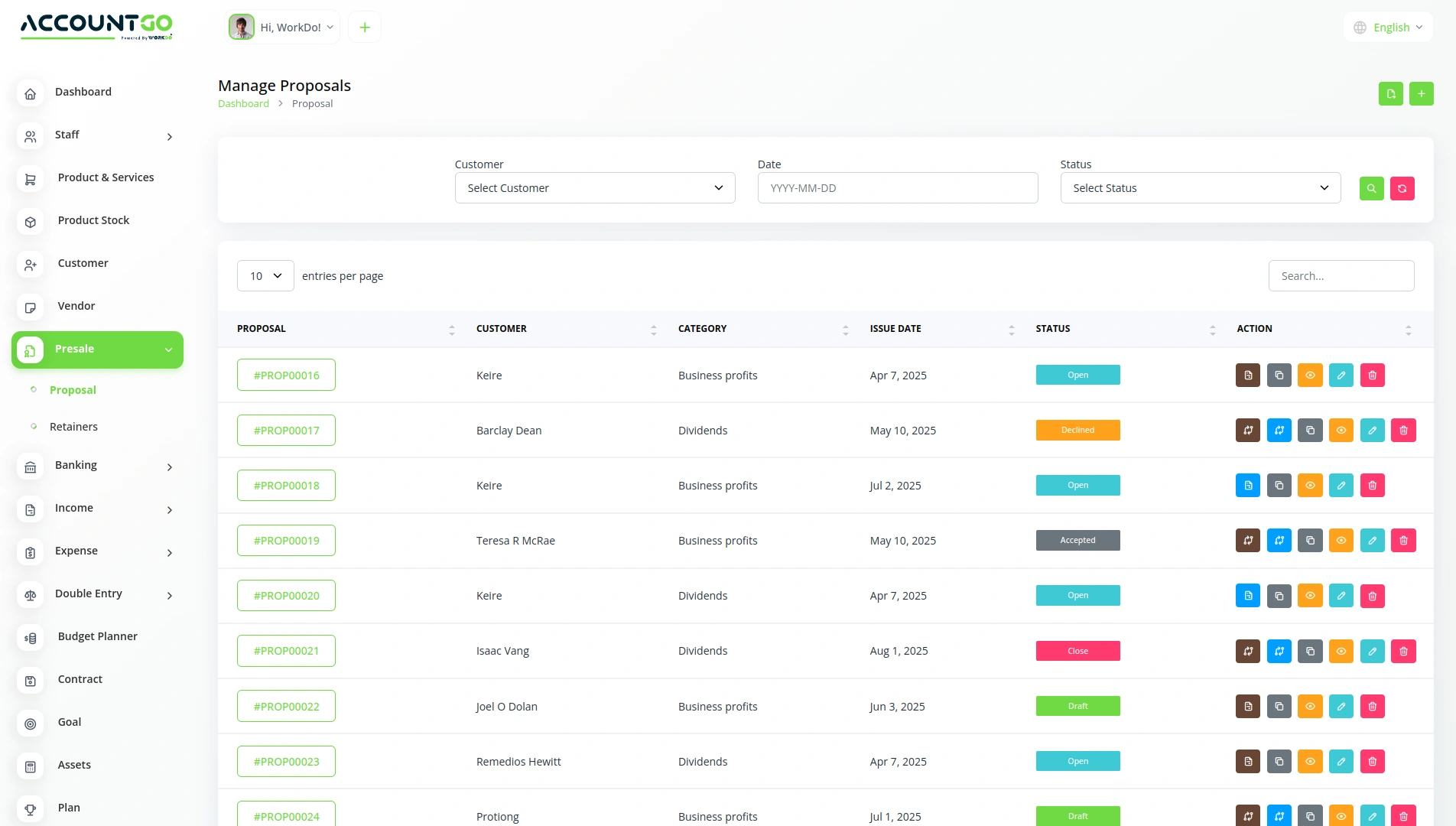

Take Your Project From Proposal to Payment

Accounting isn’t just about tracking expenses — it’s also about managing your revenue pipeline. With the right account management system, you can create proposal templates, customize them for your clients, and instantly convert accepted proposals into invoices.

Platforms like Workdo.io’s accounting system provide seamless online account management, making it easy to track invoices, set payment reminders, and monitor cash flow. This streamlines the entire process—from proposal to payment—all within a centralized system.

Using account management solutions, you can eliminate missed payments, reduce overdue invoices, and keep your books up-to-date. Whether you’re a freelancer or a growing business, this kind of customer account management software simplifies the billing cycle.

Many businesses now look for account management SaaS tools that integrate with CRM systems. That’s why Workdo.io doubles as an account management CRM, allowing you to track proposals, manage client data, and send automatic updates to customers — making it one of the best account management software options on the market.

📌 Frequently Asked Questions (FAQs)

Reach Out to Us

Have questions or need assistance? We're here to help! Reach out to our team for support, inquiries, or feedback. Your needs are important to us, and we’re ready to assist you!

Need more help?

If you’re still uncertain or need professional guidance, don’t hesitate to contact us. You can contact us via email or submit a ticket with a description of your issue. Our team of experts is always available to help you with any questions. Rest assured that we’ll respond to your inquiry promptly.

Love what you see?

Do you like the quality of our products, themes, and applications, or perhaps the design of our website caught your eye? You can have similarly outstanding designs for your website or apps. Contact us, and we’ll bring your ideas to life.