Insurance Automation, Optimize Risk, and Streamline Policy Operations

- Smart Insurance Issuance

- Seamless Policy Management

- Automated Invoice Handling

- Integrated Claims Workflow

- Advanced Risk Assessment

- Reinsurance & Underwriting Support

- Regulatory Compliance Tracking

- Fraud Detection & Marketing Tools

Explore How This Module Benefits Various Business Types

Efficient Policy Management

Centralize policy creation, issuance, and renewals to streamline operations and reduce administrative burdens.

Automated Premium Calculation

Ensure accurate premium calculations with real-time data, minimizing errors and manual input

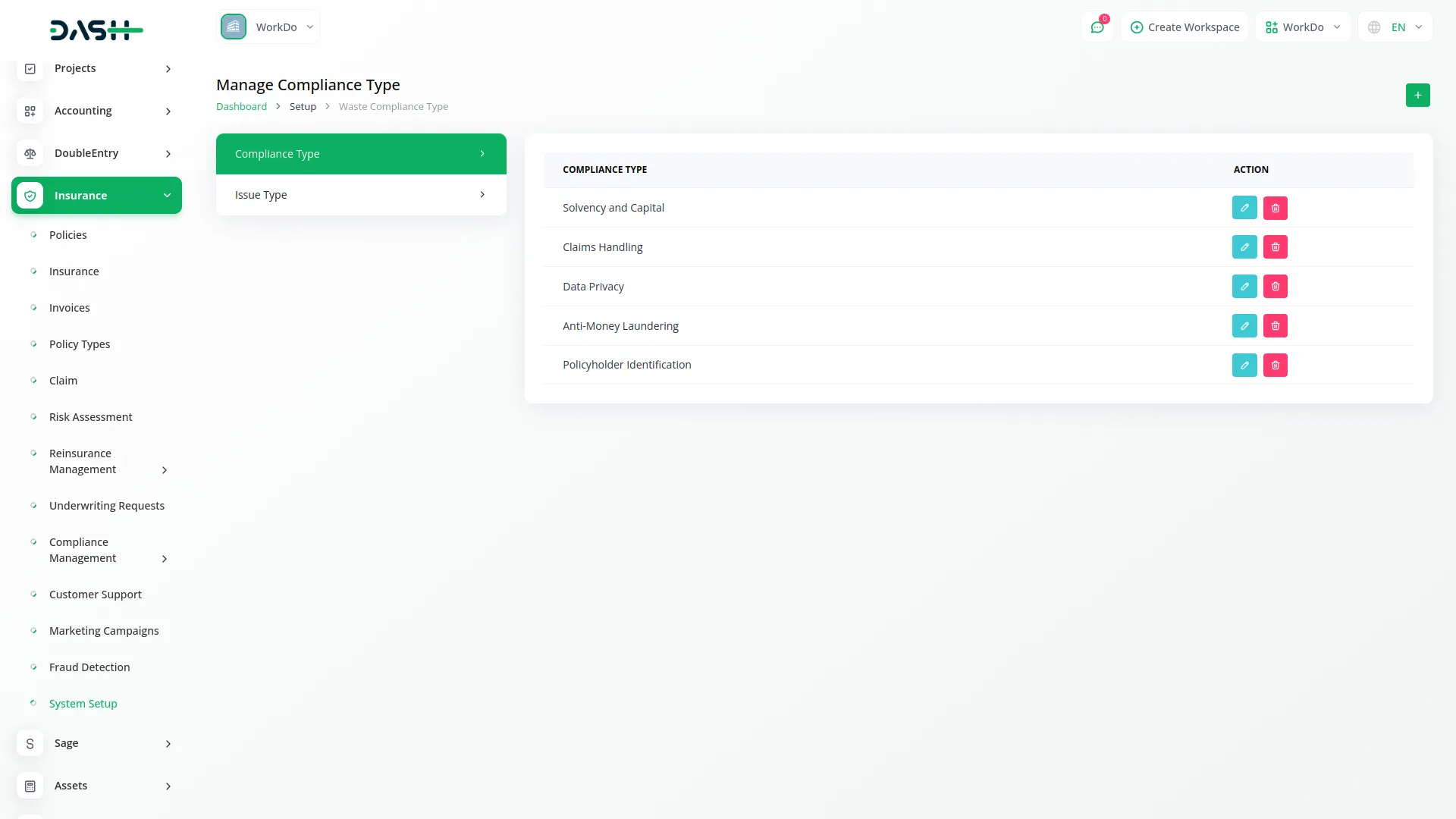

Compliance Tracking

Easily manage regulatory compliance through automated updates on industry standards and legal requirements.

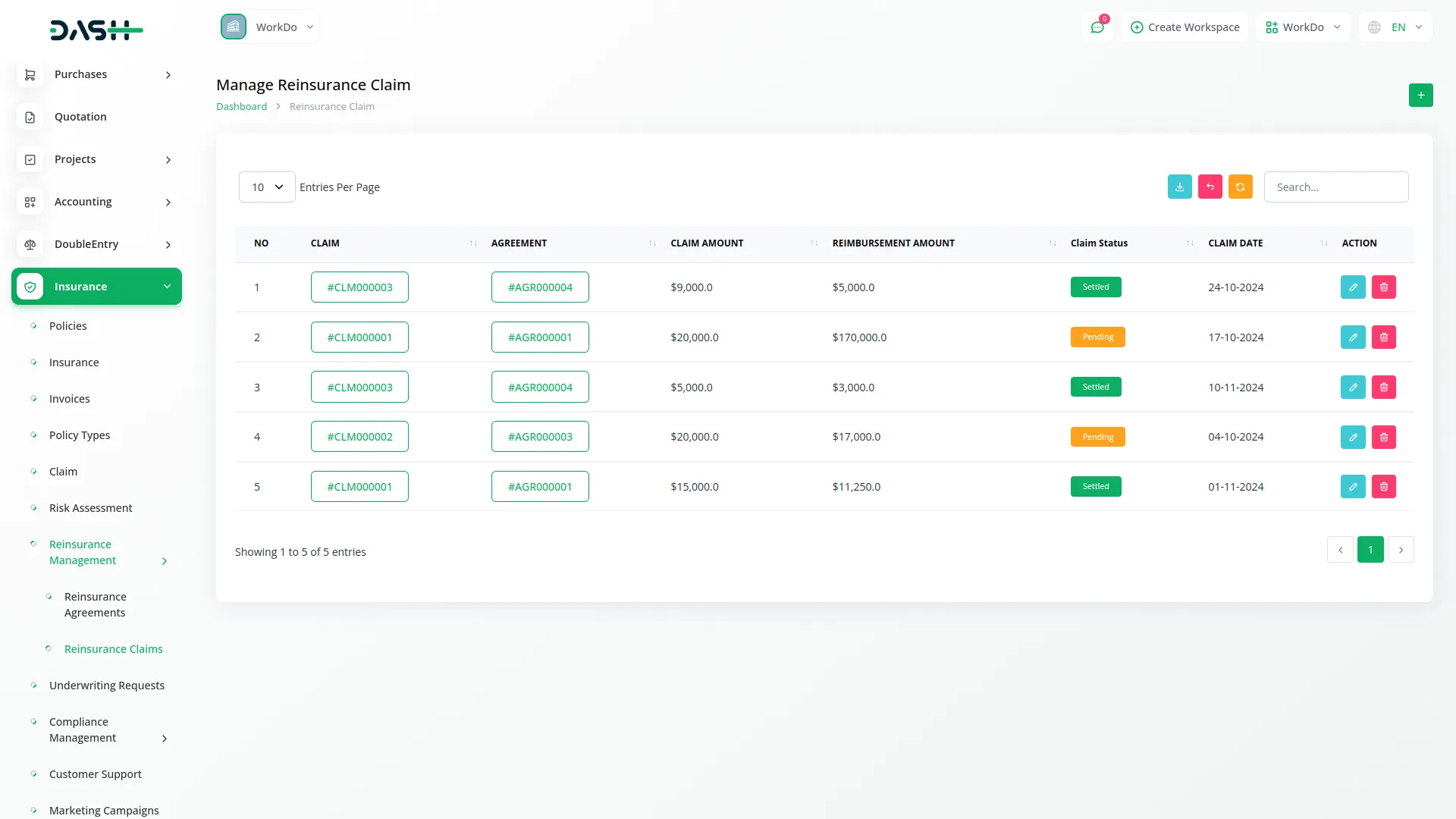

Reinsurance Agreements Management

Effortlessly track and manage reinsurance agreements, including policy coverage and premium sharing.

Reinsurance Claims Handling

Automate reinsurance claim processing and reimbursement tracking, improving efficiency and accuracy.

Risk Assessment Tools

Use detailed risk evaluation tools to assess coverage needs and adjust agreements accordingly.

Comprehensive Risk Assessment

Assess policy risk levels through detailed underwriting requests, ensuring informed decision-making.

Streamlined Decision-Making

Track and store underwriting decisions and notes in one place, reducing the time taken to evaluate risks.

Client Information Access

Access client and policy data instantly, improving the speed and accuracy of underwriting processes.

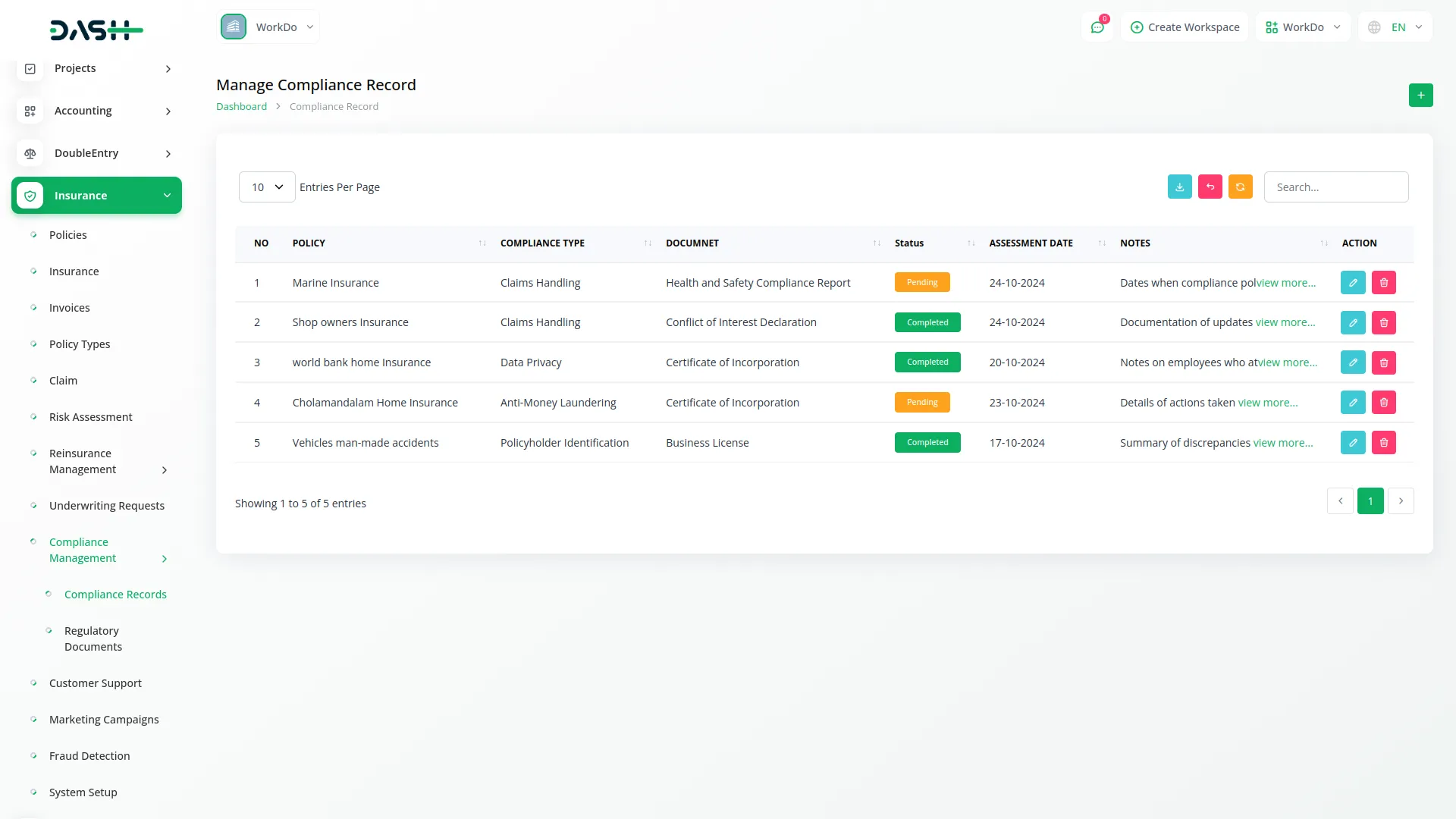

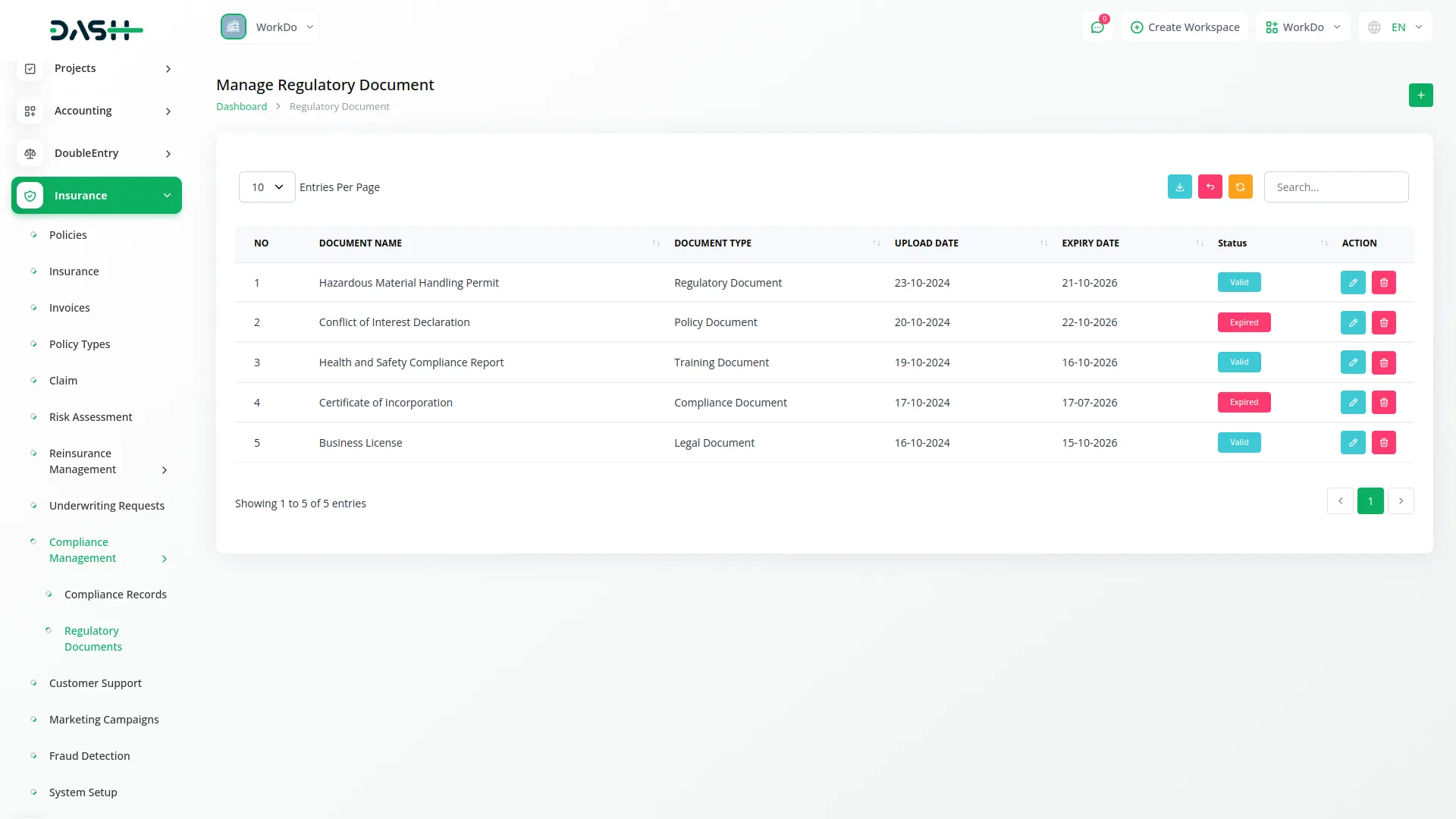

Regulatory Document Management

Organize and manage regulatory documents and compliance records, ensuring up-to-date legal adherence.

Compliance Monitoring

Keep track of compliance statuses for policies and easily generate reports for audits.

Risk Mitigation

Automate alerts for non-compliance, allowing teams to address issues promptly and avoid penalties.

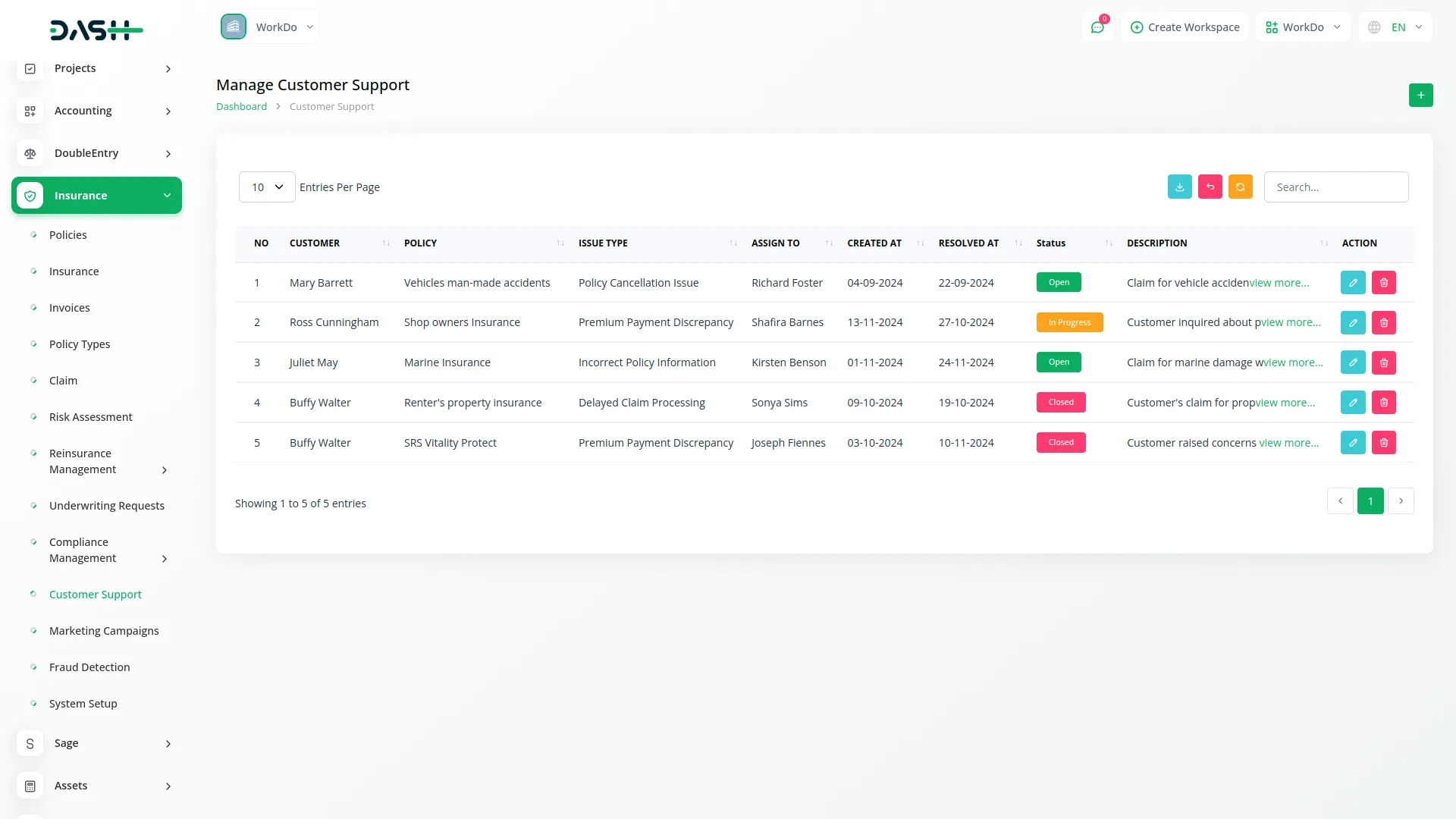

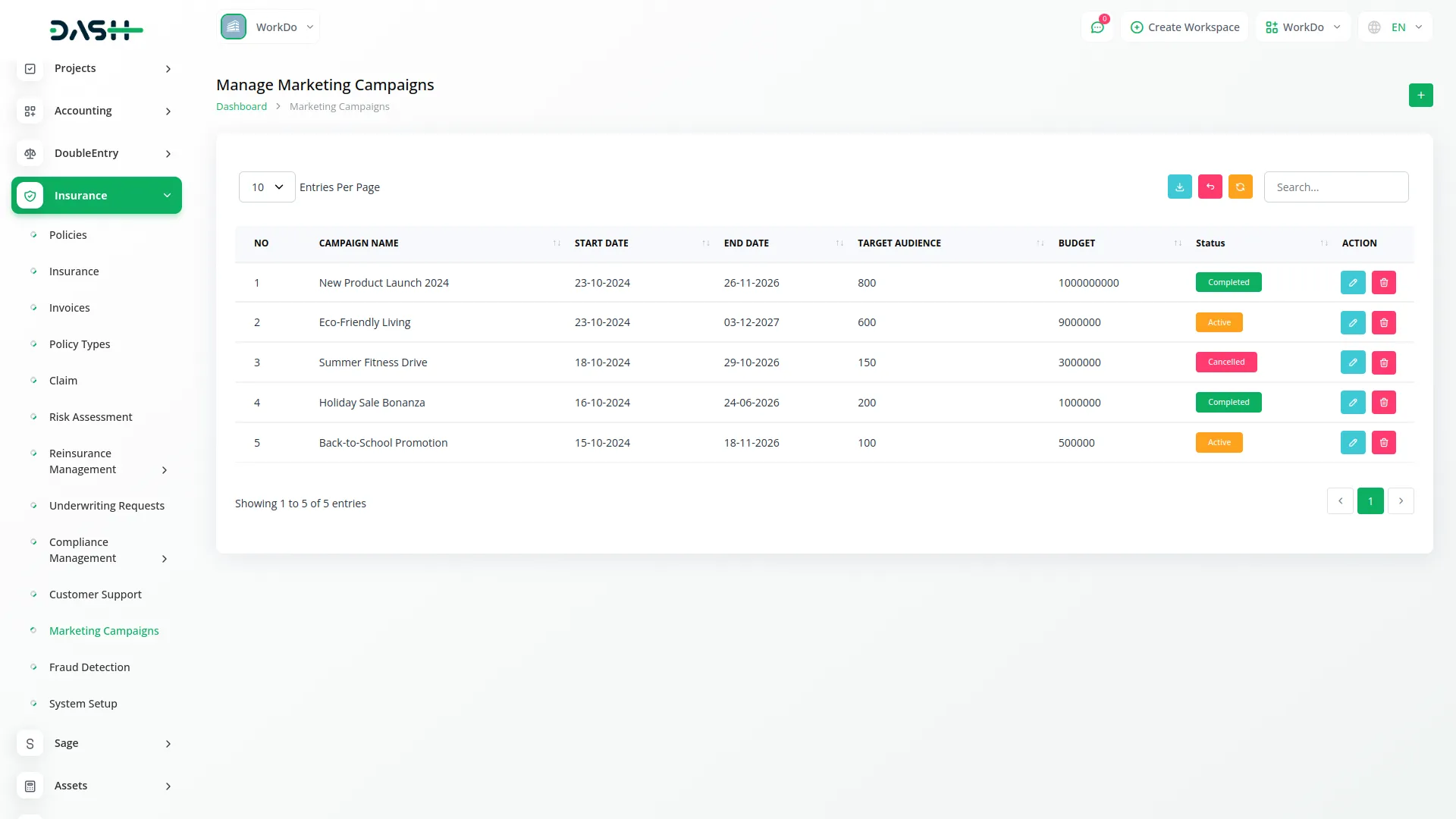

Marketing Campaign Tracking

Manage and monitor marketing campaigns targeting specific insurance customers, tracking leads and conversions.

Campaign Lead Management

Efficiently track leads generated from marketing efforts, ensuring follow-ups and customer engagement.

Budget Control

Stay on top of campaign budgets, monitoring expenses, and optimizing marketing efforts to maximize ROI.

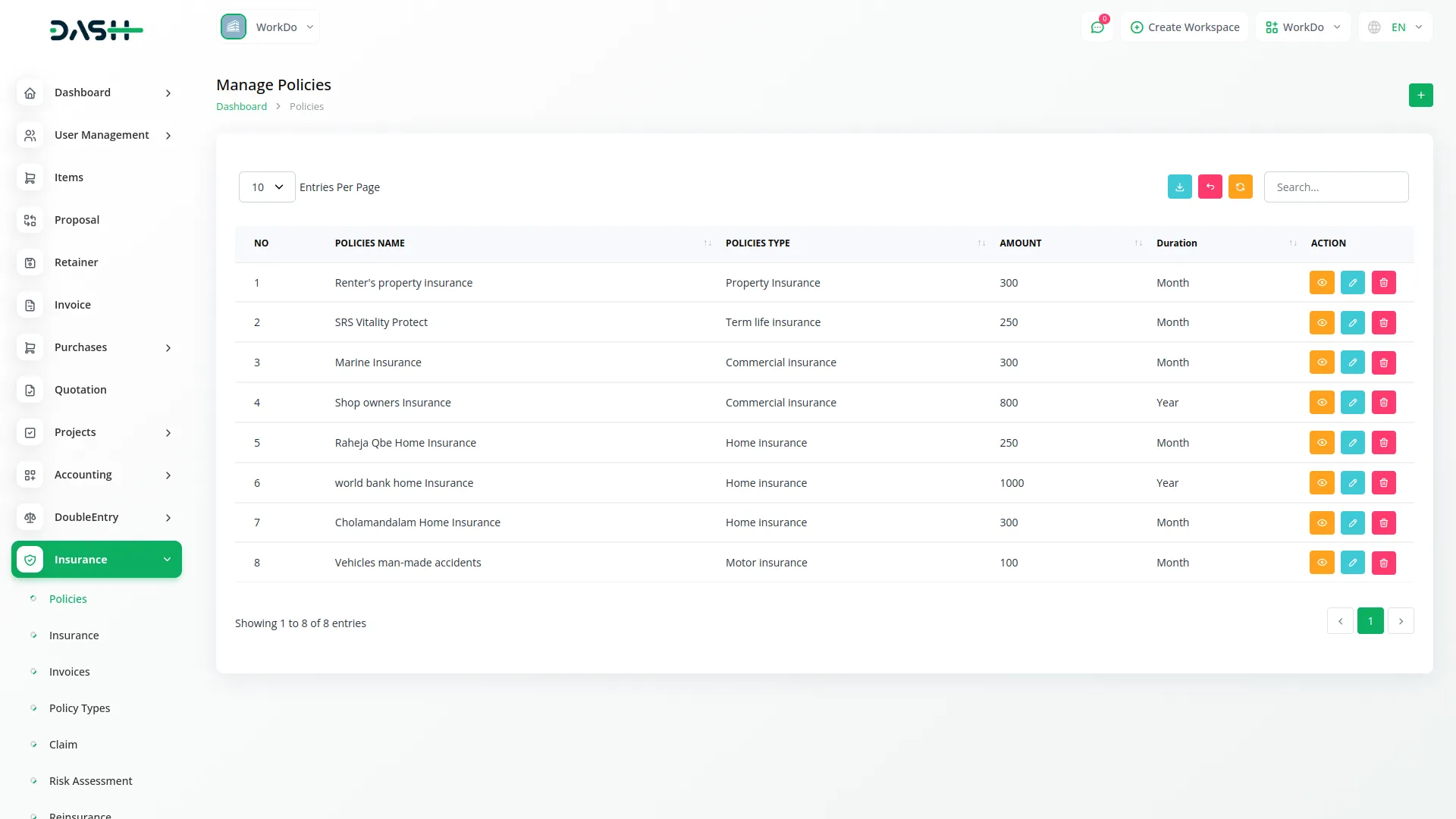

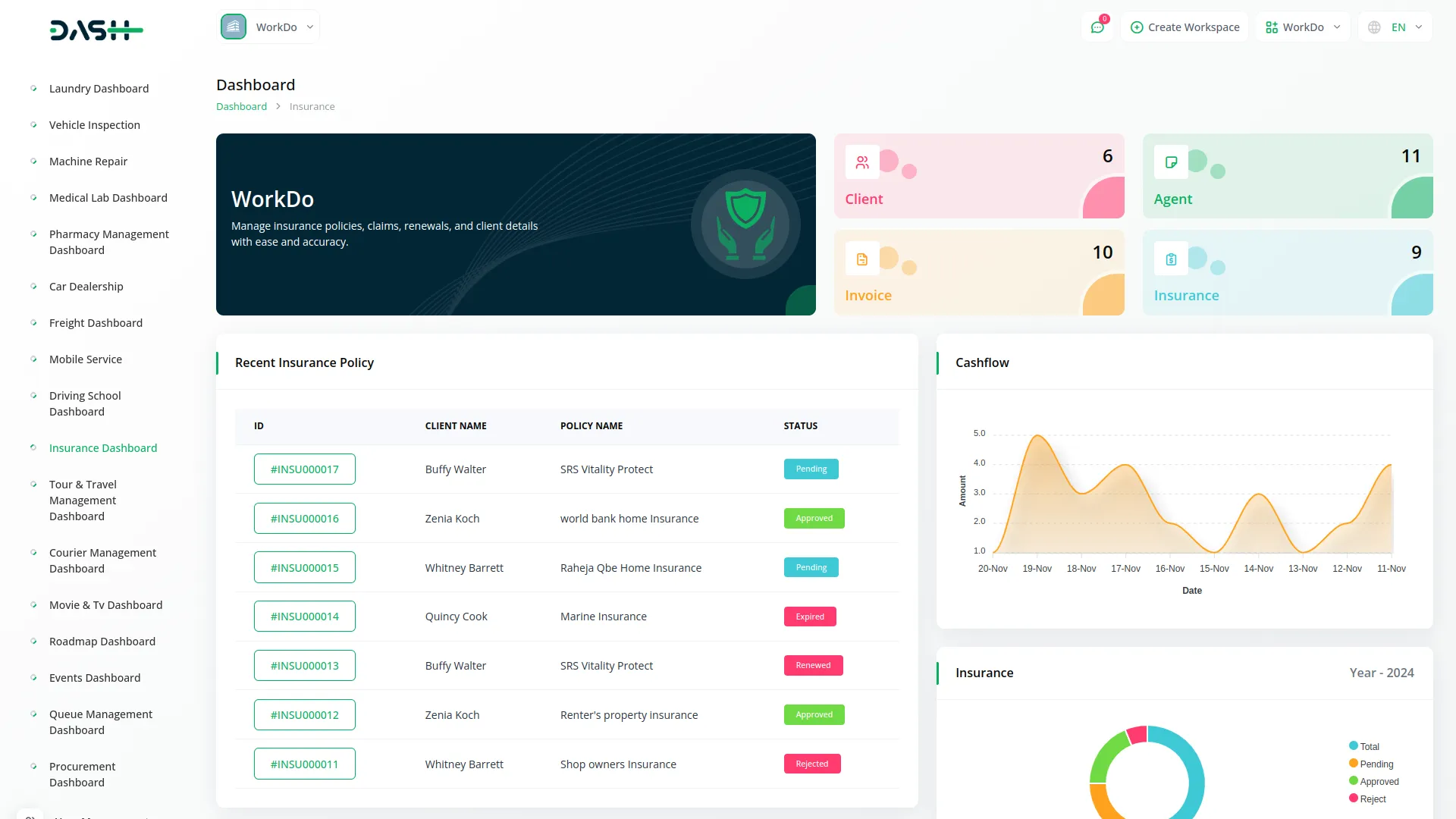

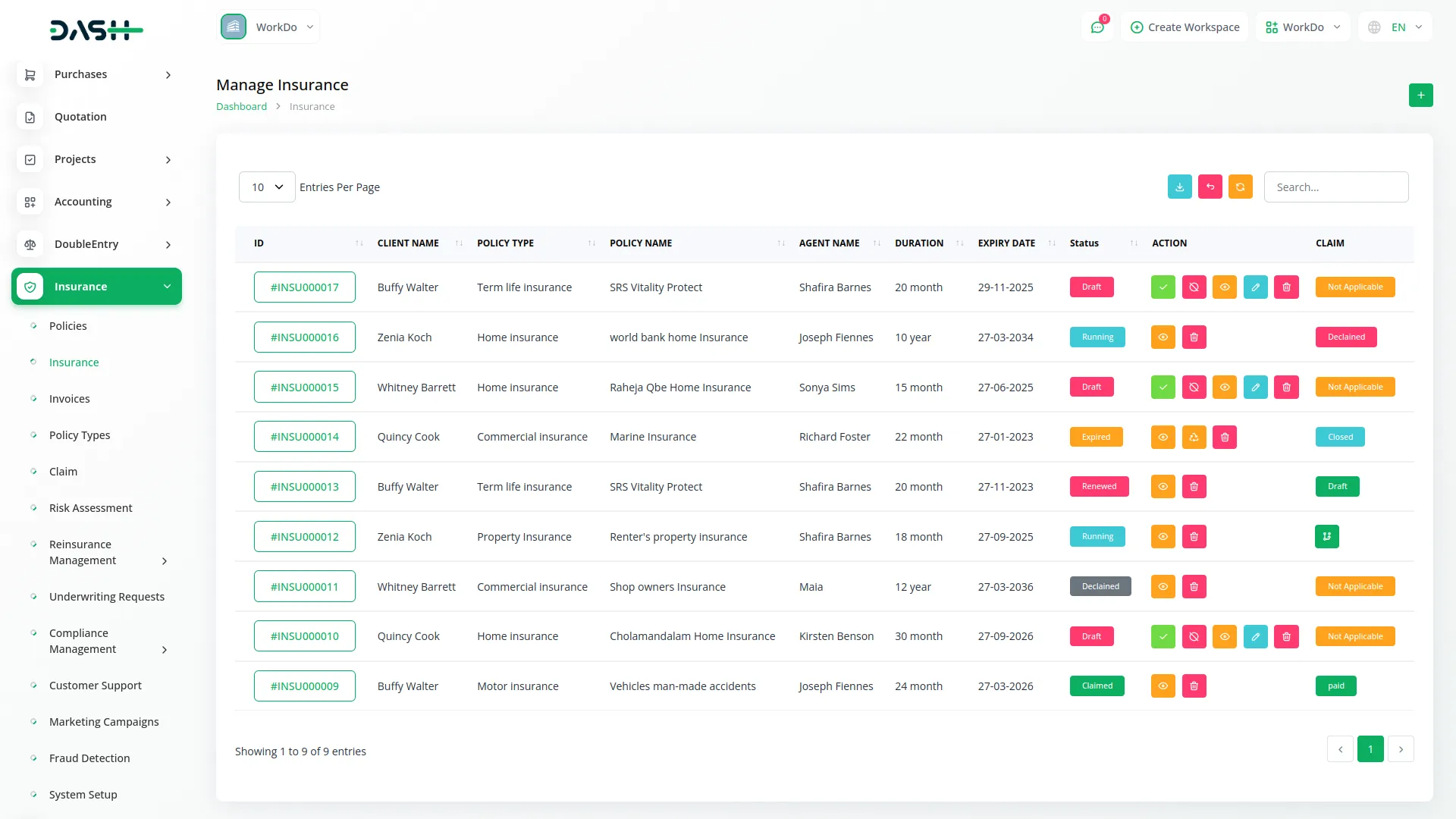

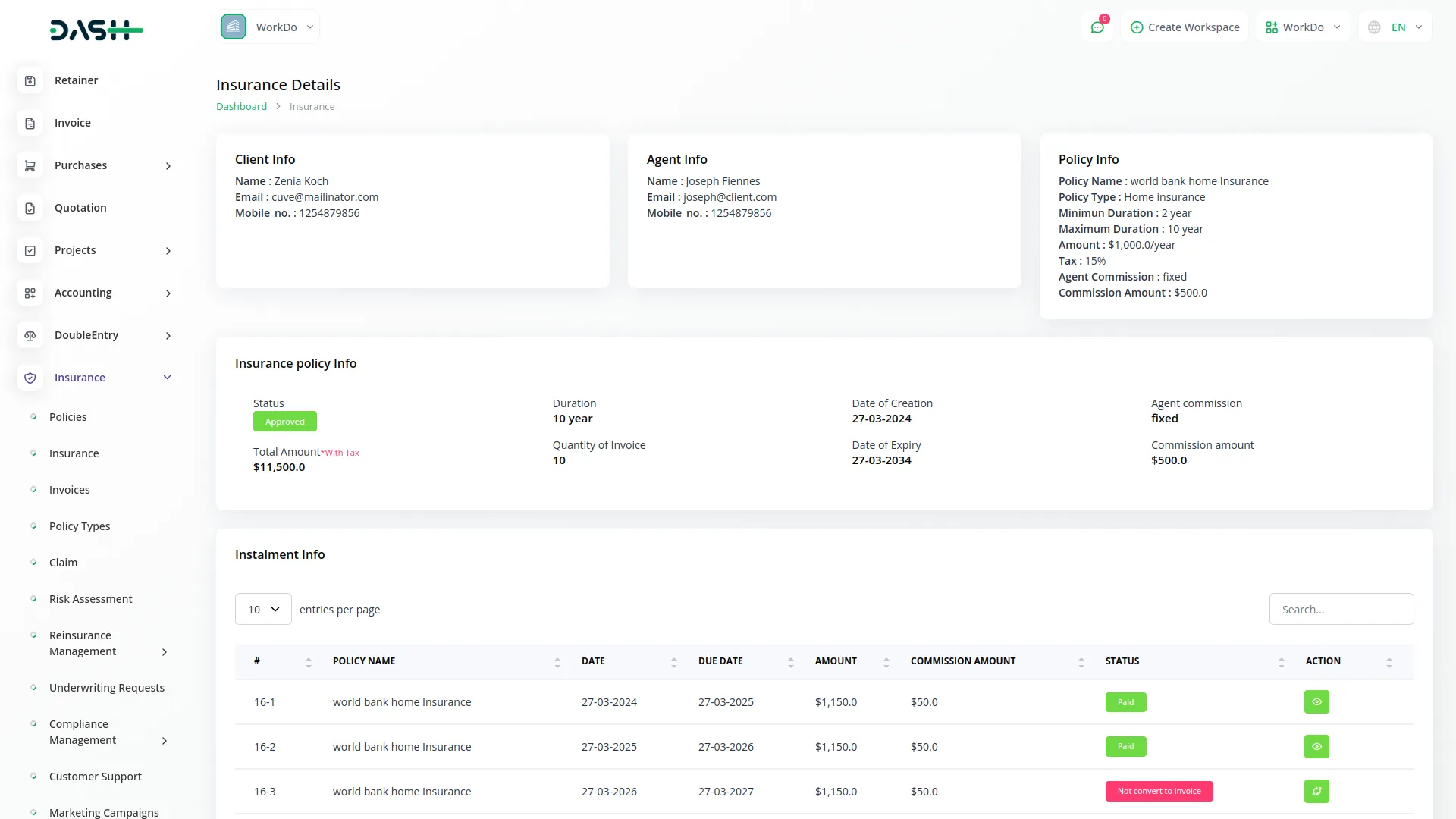

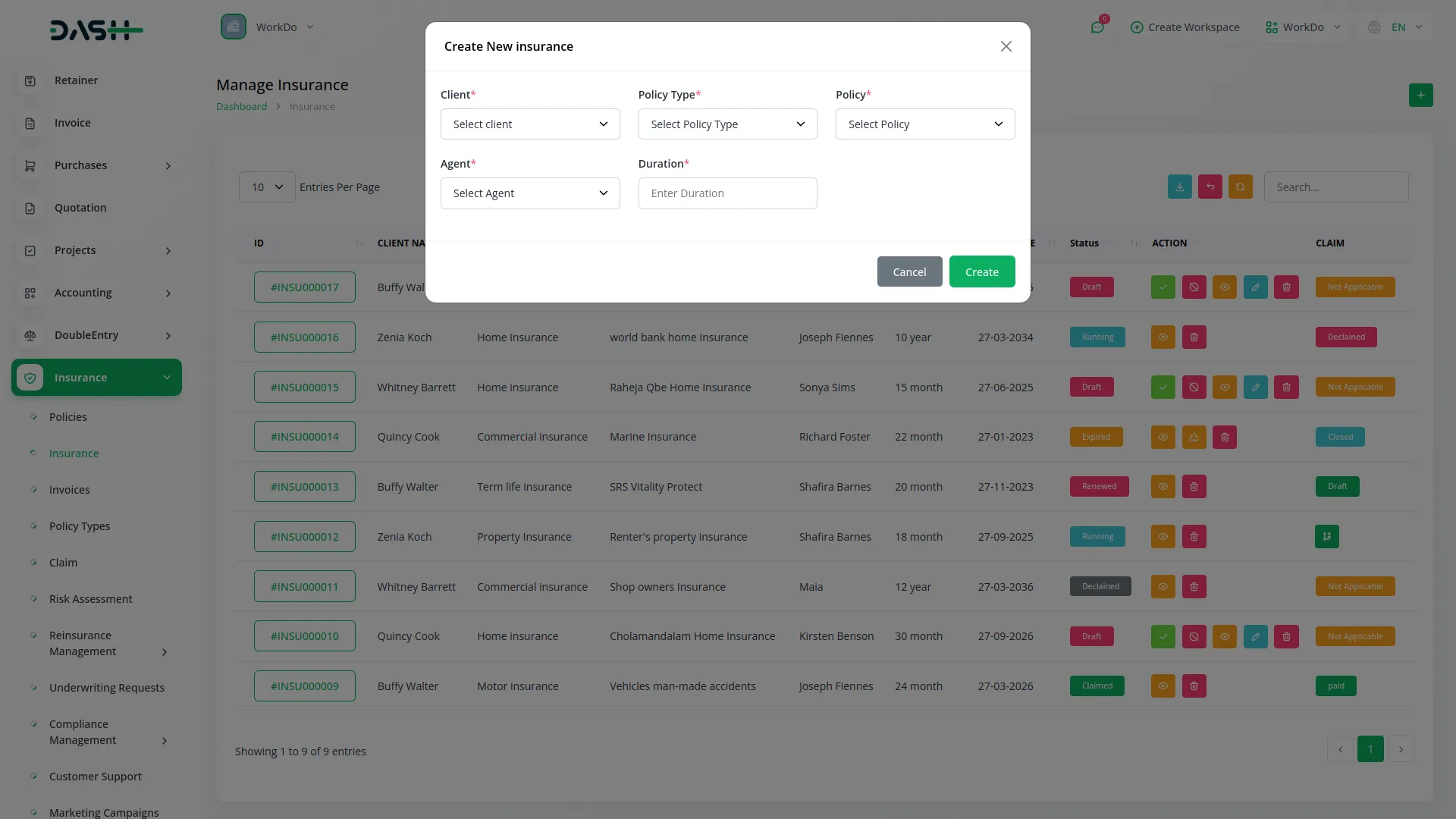

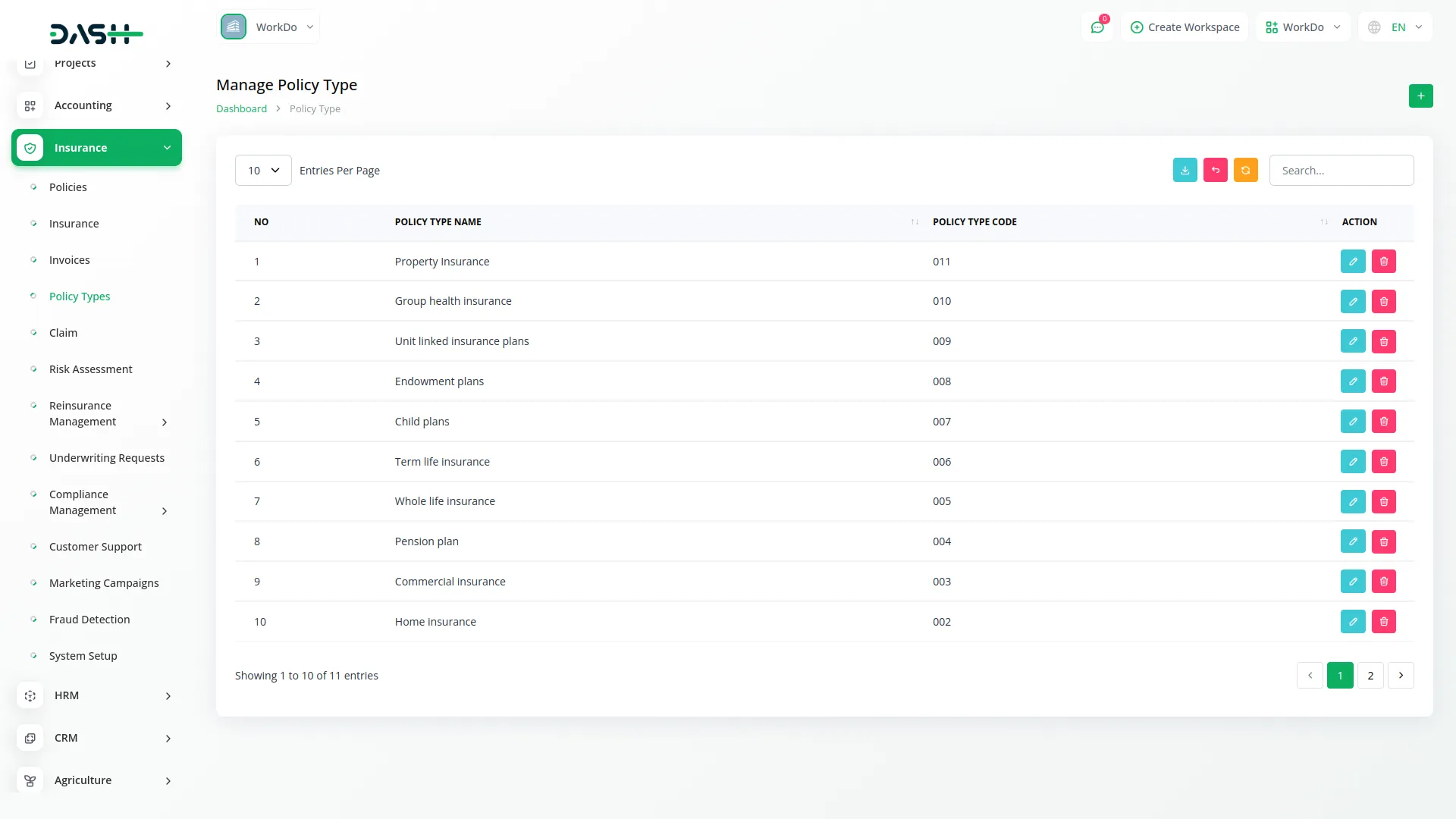

Policy Lifecycle Management

Create and manage various policy types with custom codes. Build policy records by selecting policy type, duration format, commission structure, policy amount, and taxation. Include minimum/maximum terms, tax percentages, claim limits, and detailed descriptions. Users can assign policies to agents and clients with start dates and durations. Each insurance record can be accepted or rejected and includes full detailed views with invoice conversion features. This Add-On supports a full cycle from policy design to client-specific issuance.

- Design and configure flexible, dynamic insurance policy structures

- Set up custom commission rates and tax configurations

- Assign policies seamlessly to clients and authorized agents

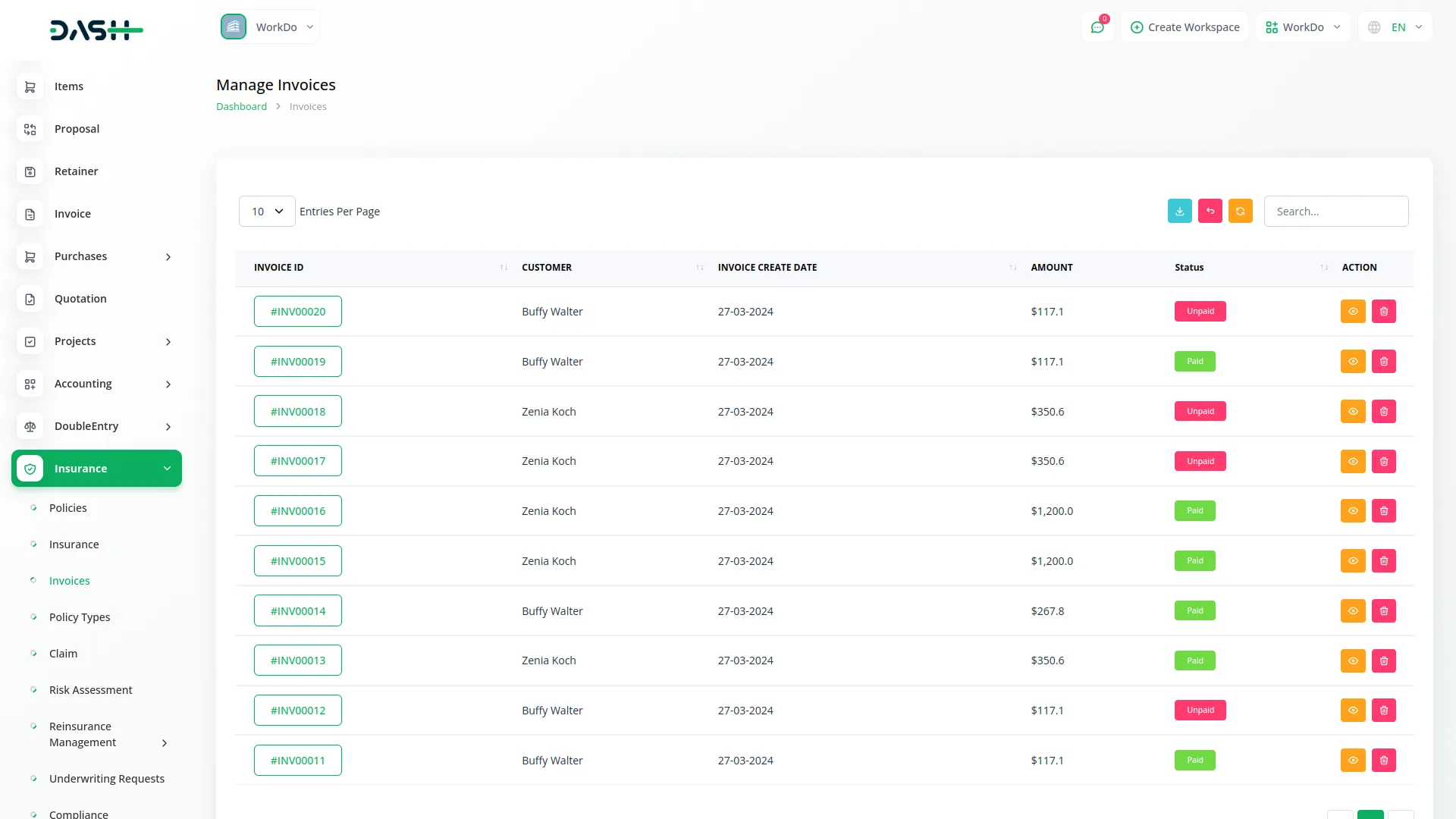

Invoice & Payment Tracking

Easily track installment-based invoices generated from insurance policies. Only invoices converted from installment data are displayed, showing amounts, creation dates, and payment status. Actions include editing and deletion, with quick views to assess payment timelines. This helps finance teams keep track of dues and ensures clear billing records for clients. All invoice statuses are used in dashboard visualizations for holistic tracking.

- Generate invoices from approved insurance installments

- Track payments efficiently based on the current invoice status

- View, filter, and manage complete invoice history records

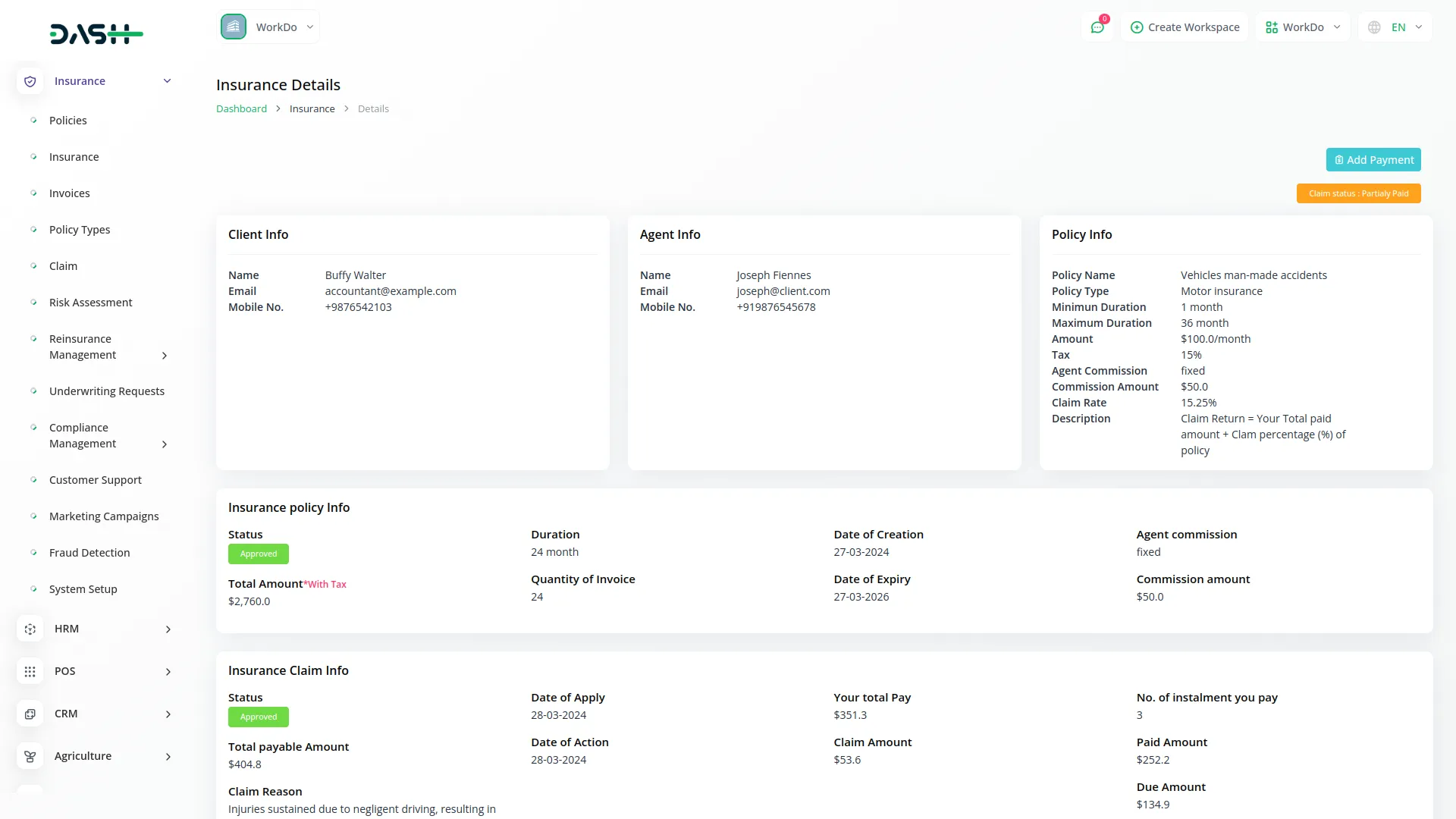

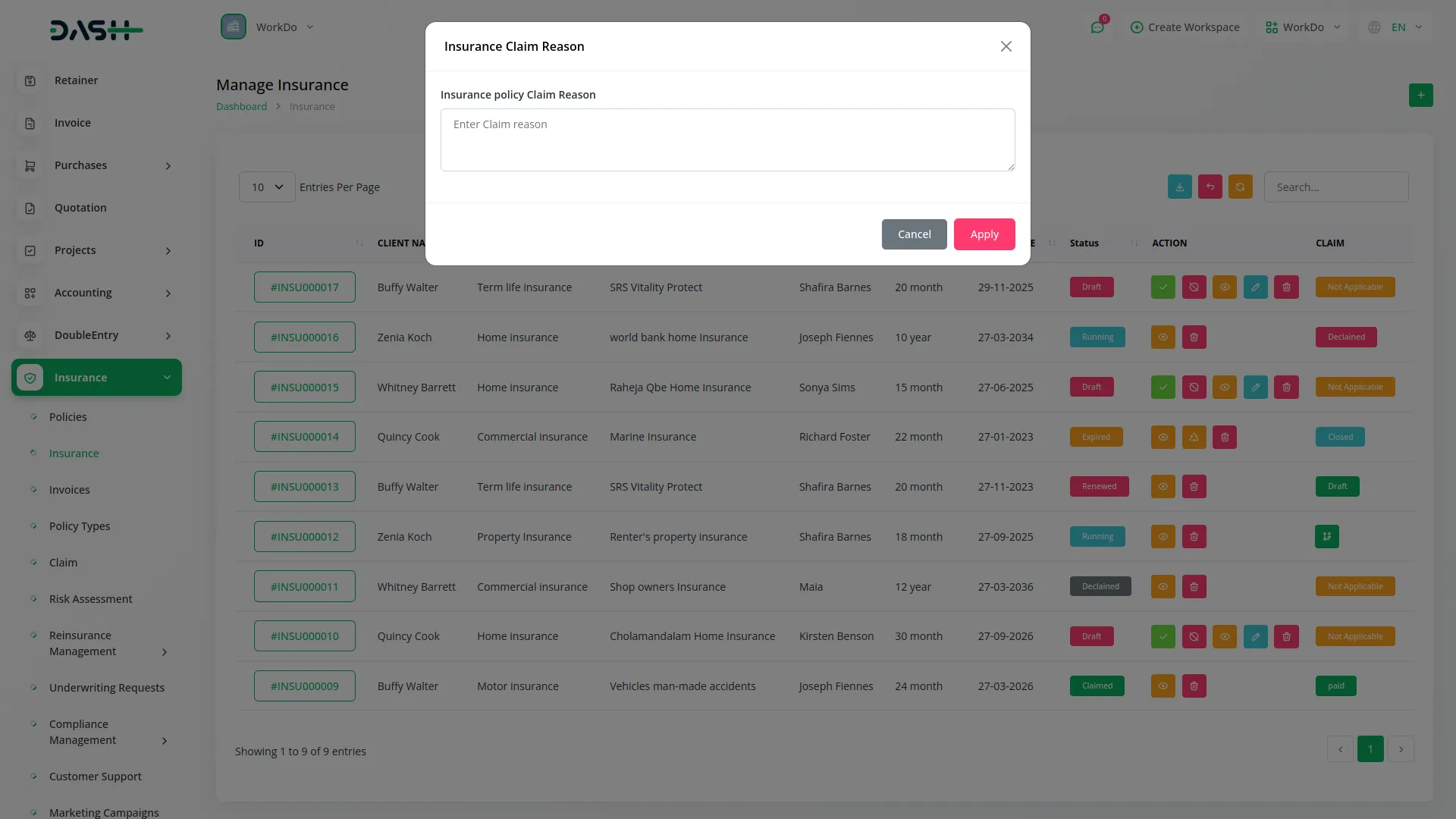

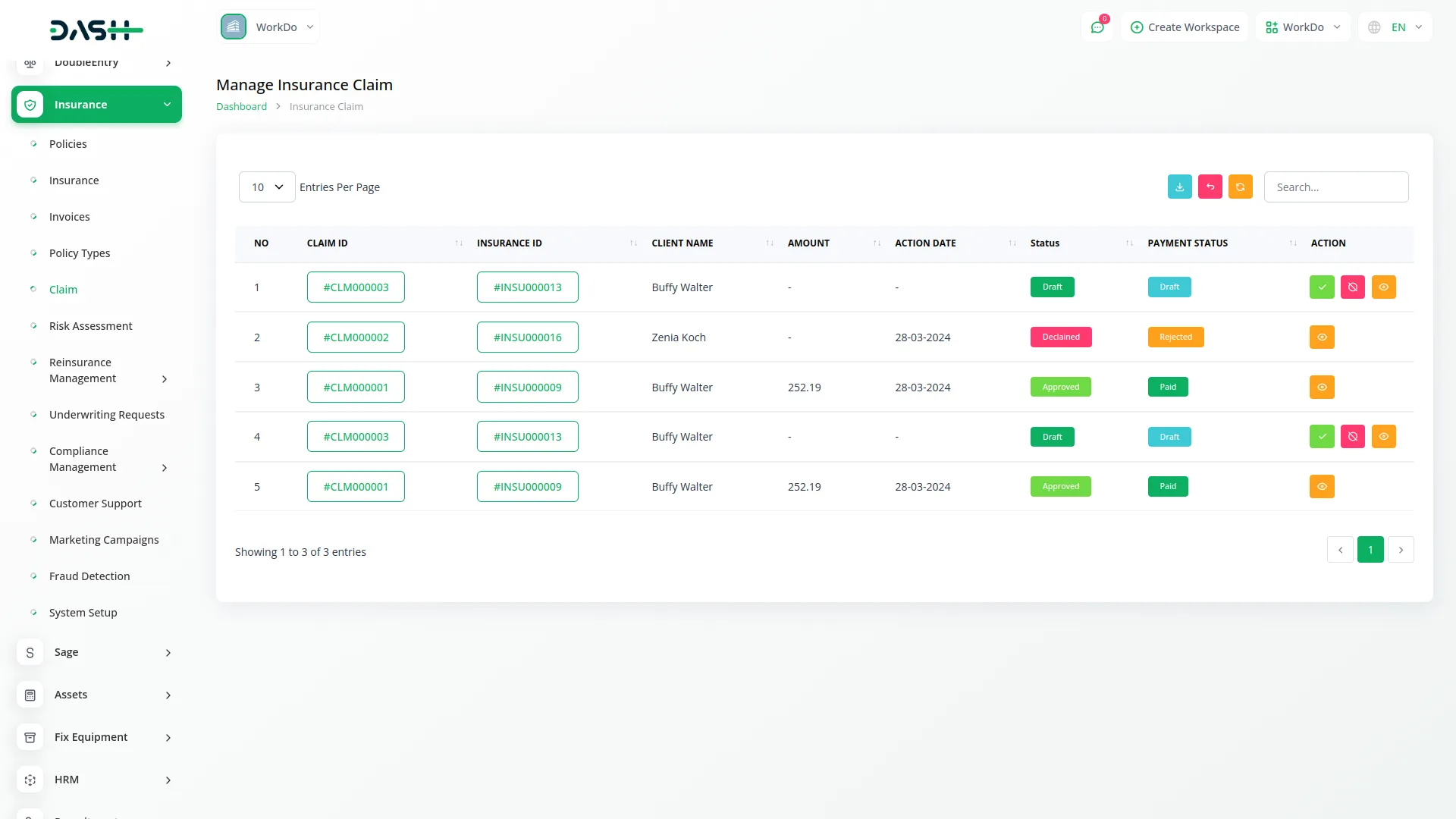

Claims Management Process

Access a dedicated space for managing client claims against active insurance. Displayed claims include status, client and policy info, action dates, and payment status. Each claim connects to an insurance record, allowing you to open detailed views that cover agent, client, and policy information, including invoices and related installments. Admins can accept or reject claims with traceable action histories, ensuring a complete audit trail.

- Manage the full lifecycle of insurance claims efficiently

- Link claims directly with related insurance policy records

- Take actions with a clear status flow and detailed tracking

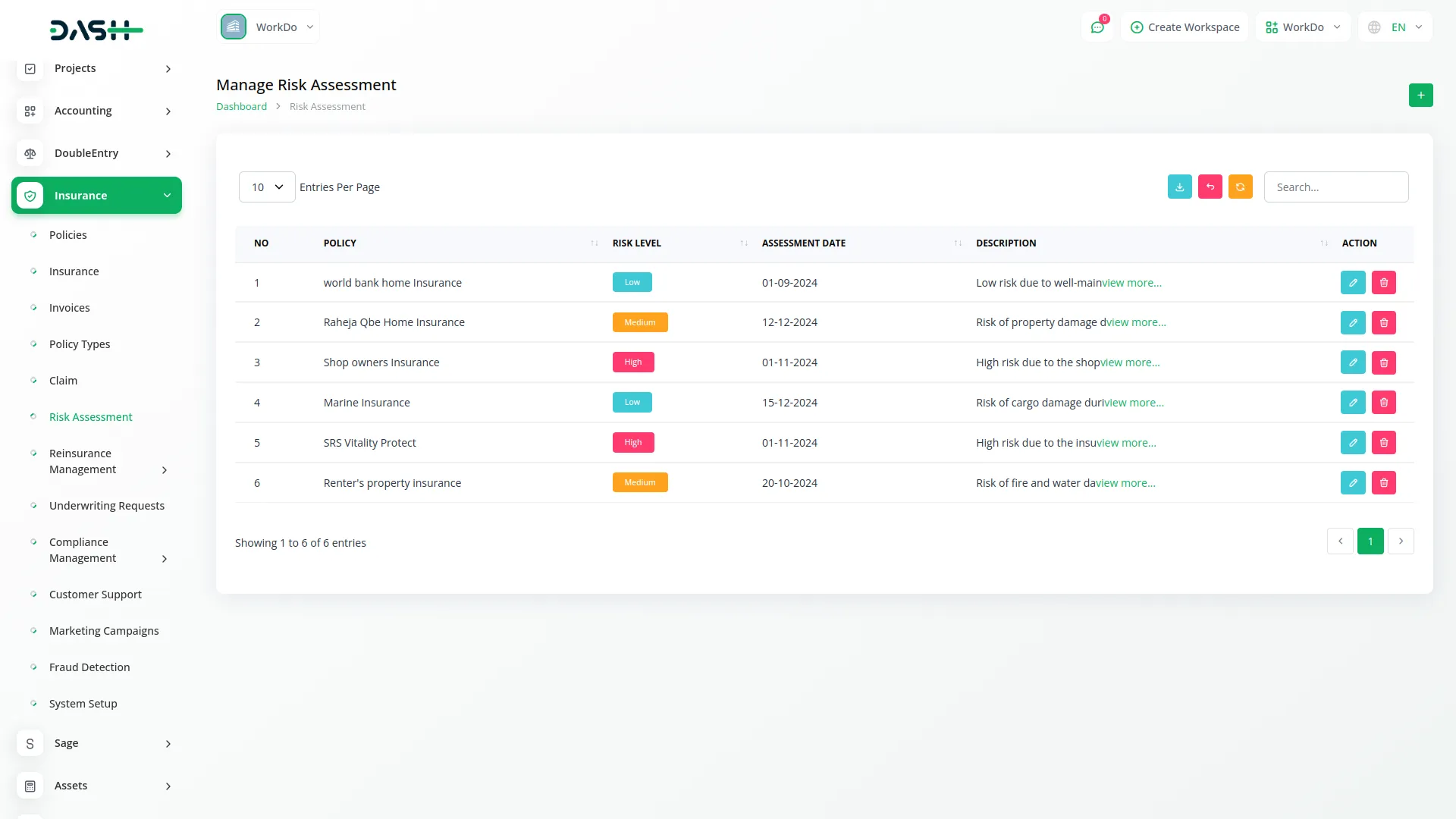

Risk & Reinsurance Controls

Assess policy risks with detailed entries including assessment date, level, and descriptions. Link risk reports to specific policies and store historical records. Add reinsurance agreements with reinsurer details, coverage and premium share percentages, agreement dates, and statuses. Claims under reinsured policies can be logged and managed, including reimbursements, statuses, and claim dates. This menu safeguards financial exposure and simplifies co-insurance tracking.

- Define and monitor risk levels linked to each policy

- Configure reinsurance agreements and track coverage details

- Track reinsurance claim submissions and reimbursement amounts

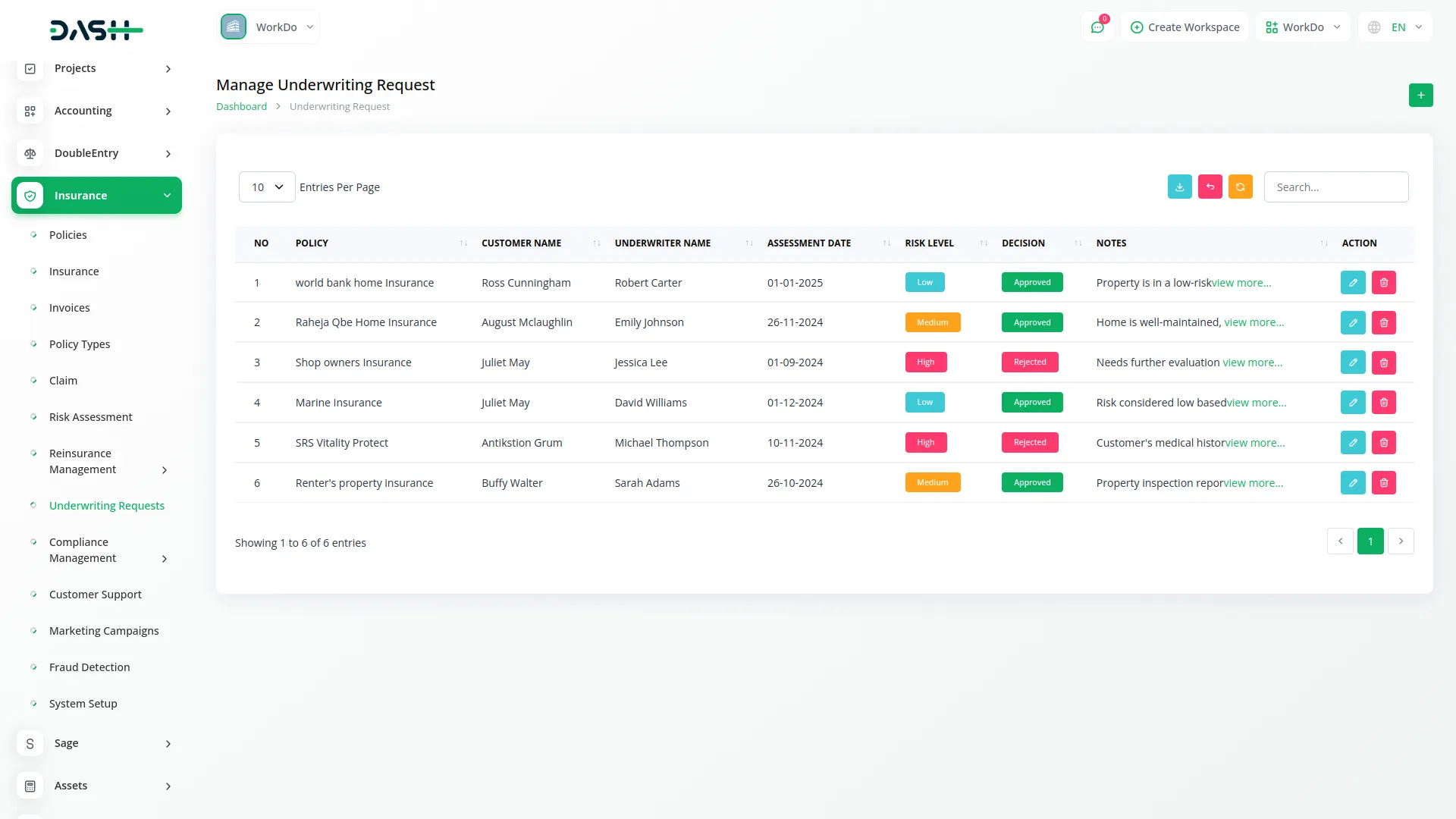

Underwriting & Compliance Records

Submit and manage underwriting requests by connecting customers to underwriters. Each request logs policy, client, risk level, decision outcome, and notes. Compliance records store assessments related to policies, such as completed or pending document evaluations, supported by document uploads. The menu ensures every policy meets legal requirements and underwriting standards. It also enables data-driven risk control across the policy lifecycle.

- Manage structured underwriting decisions with client-specific details

- Track compliance documents and ensure timely regulatory adherence

- Monitor risk levels and approval statuses across policies

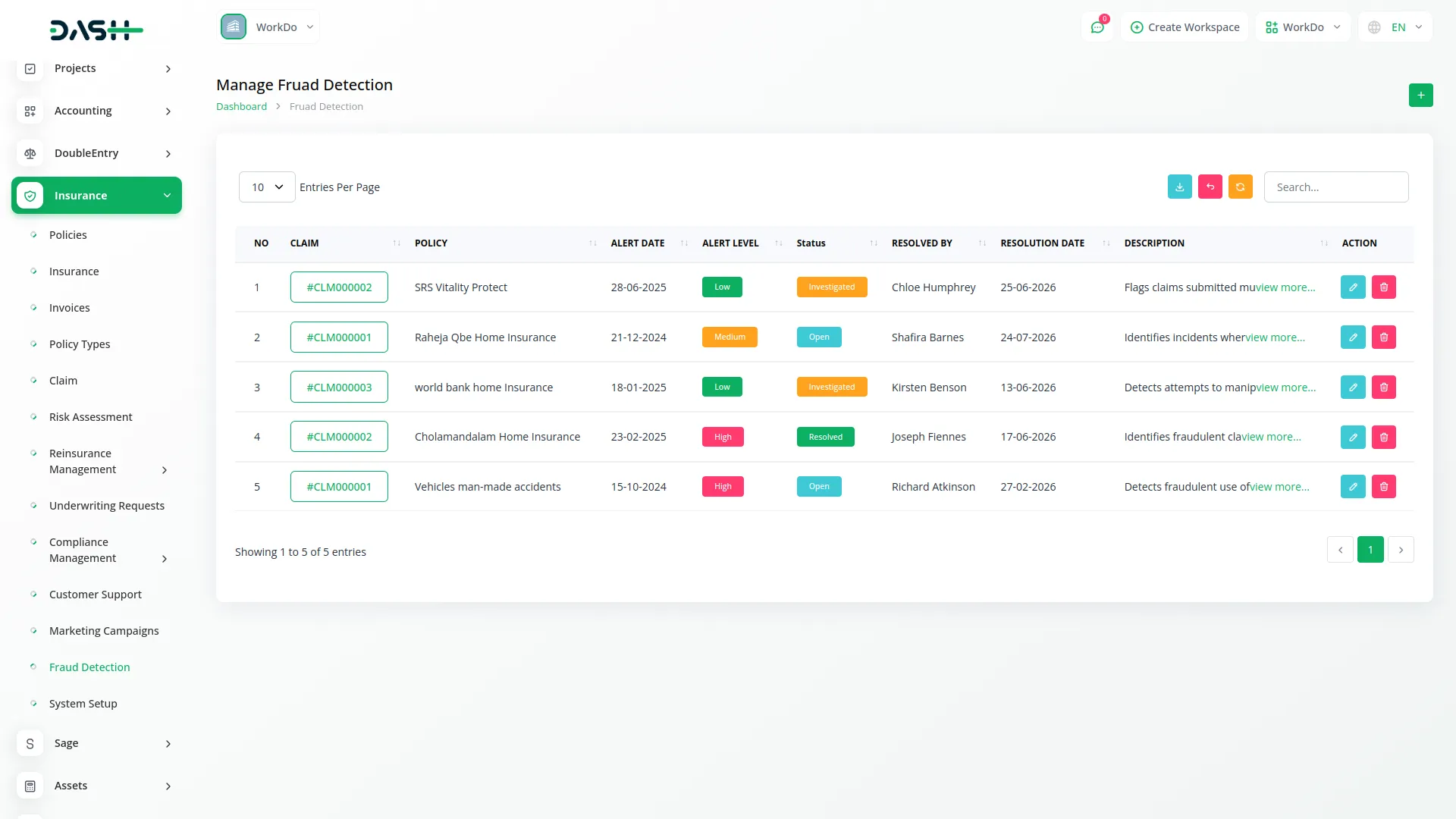

Campaigns & Fraud Detection

Launch and monitor marketing campaigns with start/end dates, audience targets, budgets, and statuses. Easily adjust active or completed campaigns to boost client engagement. Meanwhile, fraud detection entries flag suspicious claims by alert date, level, and resolution details. Admins can log actions, assign investigators, and track resolution progress — helping reduce fraudulent activities and improve trust in policy issuance and claims handling.

- Create targeted marketing campaigns with a defined audience and budget

- Identify potential fraud risks linked to insurance claims

- Track fraud case resolutions with assigned staff and notes

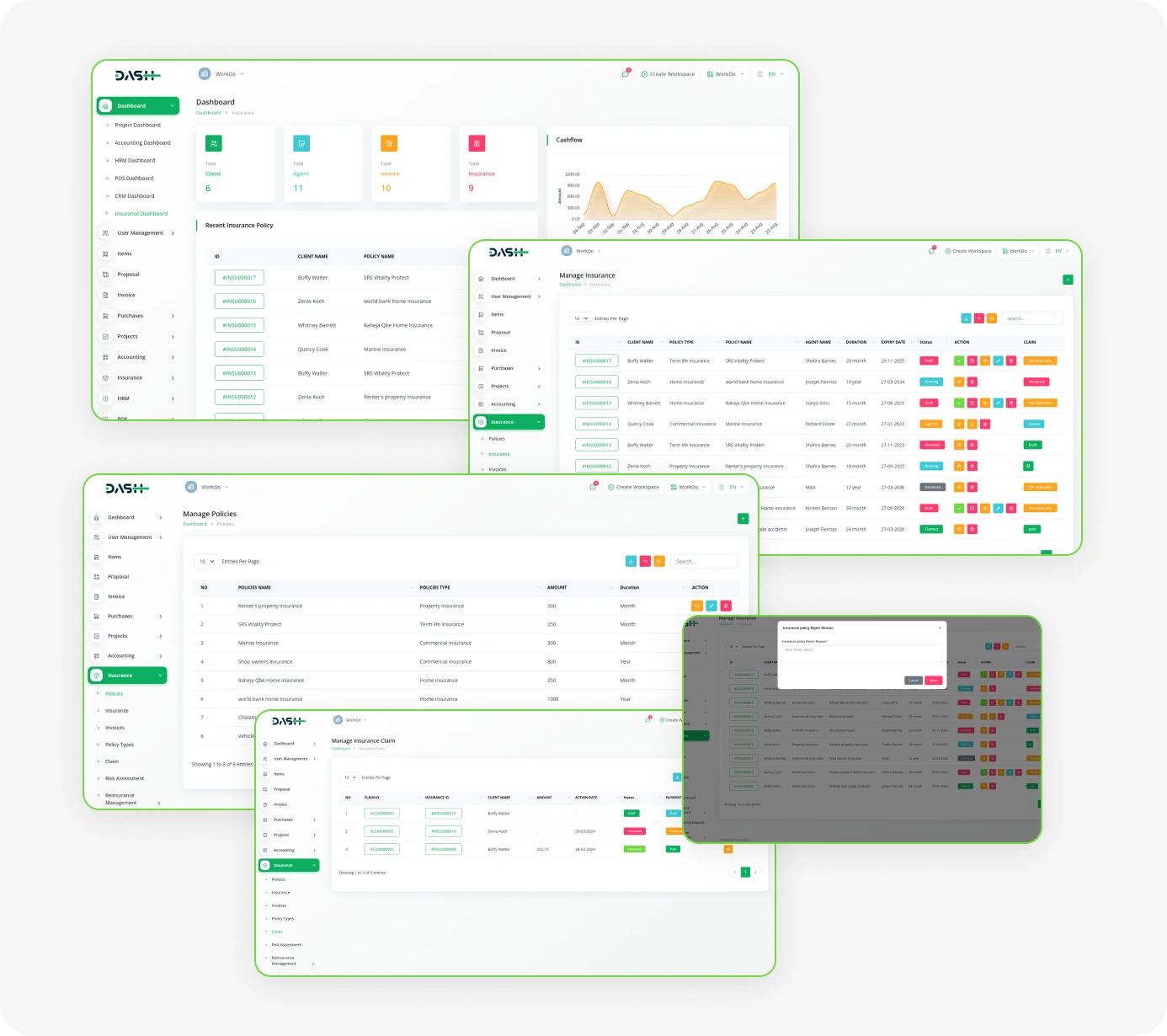

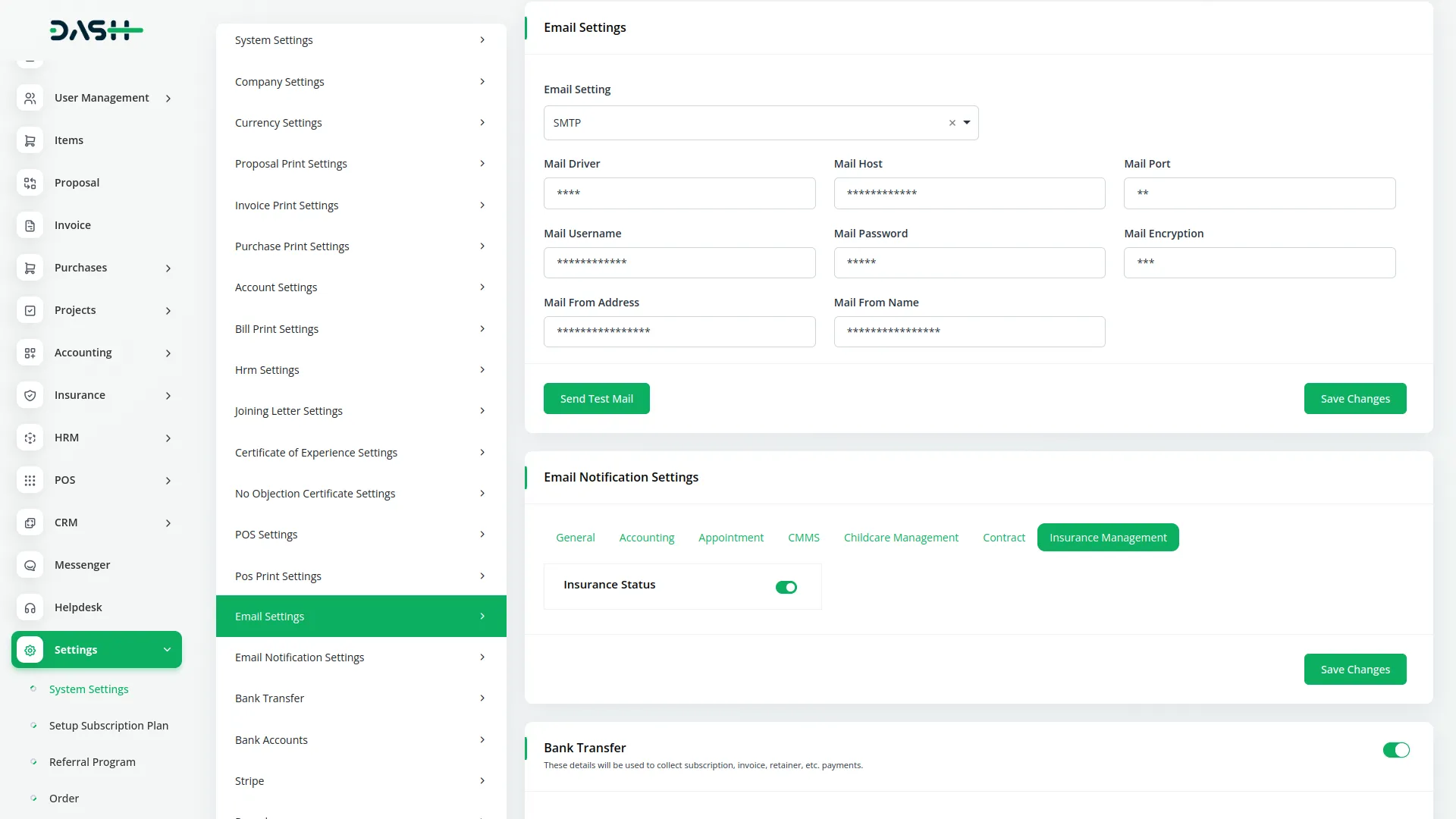

Screenshots from our system

To explore the functionality and usage of these Add-Ons, refer to the accompanying screenshots for step-by-step instructions on how to maximize their features.

5 reviews for Insurance Management – Dash SaaS Add-On

| 5 star | 60% | |

| 4 star | 40% | |

| 3 star | 0% | |

| 2 star | 0% | |

| 1 star | 0% |

Comments

You must be logged in to post a comment.

There are no comment yet.

Contact Us for Support :

-

You will get immediate support from our support desk. Please visit here https://support.workdo.io/

Item support includes:

- Answer pre-sale questions or query

- Answering technical questions about item's features

- Assistance with reported bugs and issues

- Help with included 3rd party assets

- Free Installation services in some cases

However, item support does not include:

- Customization services

Check Documents & Tutorials

The support team was extremely helpful and resolved all our questions and issues in no time, ensuring a smooth experience.

The add-on runs smoothly, even with complex insurance data, thanks to the efficient and high-quality coding behind it.

This add-on allows us to manage and track multiple insurance policies effortlessly, whether for health, life, or other types.

The user interface is intuitive and easy to navigate, making it simple for our team to use and manage policies and customer details.